Electronic Specifier highlights what Spring Budget 2023 means for innovation.

The government is committed to attracting investment to achieve a high wage high skill economy. Boosting economic growth is the only way to sustainably raise living standards and fund the high quality public services the UK population needs.

There are many underlying strengths of the UK’s economy, which will underpin future growth. The UK has a dynamic business environment and was ranked by the World Bank in 2020 as the best place to do business amongst large European nations and second only to the US in the G7.

However, UK productivity was 17% weaker in 2021 than the average across France, Germany and the US. Weakness in business investment accounts for part of this gap. UK business investment accounted for 10% of GDP in 2021 compared to 12% on average across Germany, France and the US.

There are also longstanding gaps in provision of certain skills. The share of adults with vocational qualifications, for example, is 9 percentage points below the OECD average.

The government has a plan to address these challenges and build on the UK’s areas of strength.

The Spring Budget prioritises:

- Employment: boosting labour supply, including by encouraging the inactive into work

- Education: providing everyone with the skills and support they need

- Enterprise: providing the right conditions for businesses to succeed

- Everywhere: ensuring the benefits of economic growth are felt across the UK

The government believes that people should be able to access the education and training they need to get the jobs they want. A good education system is the best economic and social policy any country can have, and education should not stop when you start work.

UK employers spend just half the European average on vocational training for their employees, and less than 10% of total spend on training goes towards formal high-quality training delivered by external institutions.

Skills Bootcamps and the Lifelong Loan Entitlement are already in place.

The government is taking bold steps to improve growth and raise economic prospects for everyone. Taken together, these announcements make a significant contribution to delivering on the government’s plan for the UK economy to grow sustainably for years to come, with the benefits of that growth spread across every part of the country.

The government will introduce the Lifelong Loan Entitlement in England from 2025, which will have a transformative impact on post-18 study, giving people the opportunity to study, retrain and upskill flexibly throughout their working lives. Individuals will be able to access loan funding for full or part-time study, for a variety of courses – from degrees to Higher Technical Qualifications – and including modular study.

To support young people into employment, the Department for Education will invest an additional £3 million over the next 2 years to pilot an expansion of the Supported Internships programme to young people entitled to Special Educational Needs support who do not have an Education Health and Care Plan.

Business investment and tax

- The government is taking further action through the Spring Budget to ensure the UK has one of the most competitive business tax regimes of major economies.

- The reliefs and allowances within the corporate tax system are an important factor in business investment decisions. The decision in the autumn to permanently set the Annual Investment Allowance at £1 million, means 99% of businesses receive 100% tax relief on their qualifying plant and machinery investments in the year of investment.

- The government also continues to recognise the importance of the UK’s world-leading shipping and maritime services industries. From June 2023, for the first time in nearly 18 years, the government will open an election window to permit shipping companies that left the Tonnage Tax regime to return to the UK, bringing with them investment and jobs

- Spring Budget also announces a range of measures to simplify customs processes, taking advantage of new freedoms following EU Exit. They will support the UK’s competitiveness and promote economic growth by making importing and exporting as easy as possible for traders, complementing wider transformational changes at the border that the government has committed to delivering.

Gerry Lianos, Co-Founder and CEO, Raffolux comments: “Raising the corporation tax rate to 25% is clearly going to have some negative effects on businesses looking to set up in the UK. At Raffolux we would hope that the chancellor would look to offset this rise in taxation with other benefits, such as an expansion of the SEIS/EIS scheme to help balance this out and support emerging SMEs. We do however welcome the increase in the Small Business Investment Allowance which will encourage businesses like ours to invest in future growth.”

High growth sectors

The government will turn its vision for UK enterprise into a reality by supporting growth in the sectors of the future. There are opportunities to accelerate the progress of the technologies that will define this century by encouraging investment and smarter regulation.

This will support the government’s aim to capture a share of growing global markets in:

- green industries

- digital technologies

- life sciences

- creative industries

- advanced manufacturing

Cutting-edge companies across these high growth sectors need access to sufficient finance to be able to start, scale and stay in the UK. Since the Patient Capital Review in 2017, the government has delivered a series of reforms to increase investment into innovative scale-up companies, and the UK’s venture capital financing gap with the US has halved.

The Spring Budget signals the government’s ambition with an initial package:

- Increasing support for the UK’s most innovative companies by extending the British Patient Capital programme for a further 10 years until 2033- 34 and increasing its focus on R&D intensive industries, providing at least £3 billion in investment.

- Spurring the creation of new vehicles for investment into science and tech companies, tailored to the needs of UK DC pension schemes, through a new Long-term Investment for Technology and Science (LIFTS) initiative. At Spring Budget, the government is inviting feedback on the design of the competition.

- Leading by example by pursuing accelerated transfer of the £364 billion Local Government Pension Scheme assets into pools to support increased investment in innovative companies and other productive assets. The government will shortly come forward with a consultation.

Sarah Glichriest, President, Circus Street comments: “The Government has made it clear that it wants to get more people back into work and encourage people to retire later in life. To make this achievable the UK has to completely revaluate its relationship with skills training. The reality is that many people in the workforce do not have the right skills to adapt to new technologies and ways of working. This has a direct impact on productivity, business resilience and innovation. This skills gap is even wider for many older people and those that have been out of the workforce for a number of years.

“Currently, the Government has only announced modest skills programs and concentrated on initiatives like the Apprenticeship Levy. These plans are not ambitious enough or, in the case of the Levy, are heavily geared towards larger companies at the expense of SMEs.What we need is a much more wide-ranging, long-term plan. Ideally, we need to bring the funding and reach of the Government, together with the needs of businesses, knowledge of academic institutions, and expertise of training specialists to create a national program that tackles every stage of an individual’s career.

“At the moment, there simply aren’t enough people with, for example, digital and data skills to enable British businesses to digitally transform and remain competitive on a global basis. The pandemic made it clear just how important these skills are to enable companies to quickly adapt to new challenges and take advantage of new opportunities.”

The UK has long been a leading location for digital and technology companies to innovate and do business. However, this report highlights that there are areas where the government can further ensure that the UK’s regulatory environment enables innovation and a thriving digital economy. From better regulating the applications of AI, to promoting openness of public data and accelerating legislation to bring forward the future of transport, Sir Patrick’s report presents ambitious ideas to unlock progress.

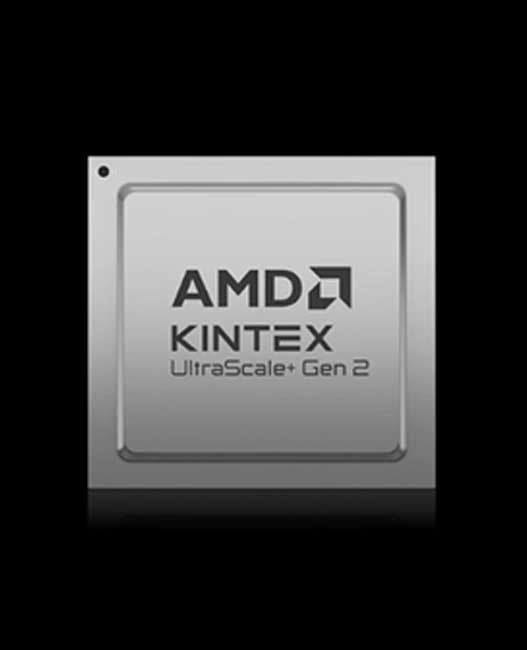

Further investment is needed in infrastructure for research and innovation. Powerful computing capability is an essential component of being a global hub for innovation and achieving the UK’s ambition to be a science superpower. Compute is also essential to progress in Artificial Intelligence research.

However, according to the independent Future of Compute Review, published last week, the UK’s most powerful computer ranks just 28th in the world. The Review also found that the UK’s AI community has immediate requirements for large-scale, accelerator-driven compute to remain internationally competitive.

In line with two of the key recommendations of the Future of Compute Review, the government will invest, subject to the usual business case processes, in the region of £900 million to build an exascale supercomputer and to establish a new AI Research Resource, with initial investments starting this year.

Together, these will provide significant compute capacity to our AI community and provide scientists with access to cutting-edge computing power.

They will allow researchers to better understand climate change, power the discovery of new drugs and maximise our potential in AI.

Recent developments in AI, such as the launch of ChatGPT and the announcement of Google Bard, have shown the powerful potential for technologies which are based upon foundation models, including large language models.

As announced alongside the refresh of the Integrated Review, government will establish a taskforce to advance UK sovereign capability in foundation models, including large language models, and provide direct advice to ministers, to ensure that the UK is at the forefront of this technology.

The government will award a £1 million prize every year for the next 10 years to researchers that drive progress in critical areas of AI.

Beatrice Barleon, Head of Policy & Public Affairs at EngineeringUK: “We welcome the Government’s ongoing commitment to make the UK a science and technology superpower and the ambitions of growing the economy, meeting our Net Zero targets, and unlocking the potential of every region. We also welcome the acknowledgement that to achieve this, businesses, including engineering and technology businesses, urgently need a larger skills and workforce base, now and in the future.”

“However, the measures on childcare as well as the focus on those over 50 will not, on their own, solve the wider skills and workforce shortages in the engineering and technology sector in the long-term. We urgently need greater investment in and focus on STEM education, STEM teachers, careers provision and vocational pathways for young people,” added Barleon.

“Our Fit for the Future Inquiry into engineering and technology apprenticeships will be reporting later this year and we hope to work closely with the Treasury to explore how they can support growth across the engineering profession.”

Commenting on R&D changes, Verity Davidge, Director of Policy, said: “While the Chancellor set out big and ambitious plans for AI and quantum, the focus on diffusion and adoption of digital adoption overall is lacking. R&D tax credit policy keeps chopping and changing and many businesses will struggle to keep up. Large swathes of small and medium sized manufacturers will find themselves out of pocket when the new changes come in in April this year and we were looking to the Chancellor to delay, or even better, reverse these changes to boost R&D across all of manufacturing.”