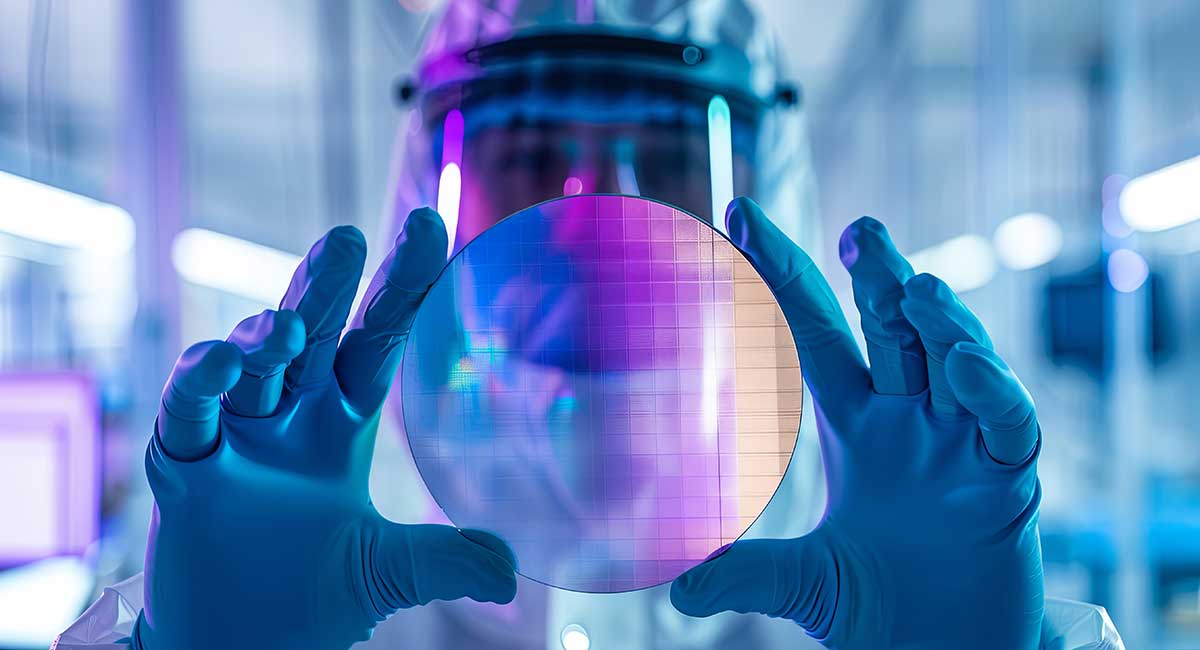

Here’s the problem: microchips are essential parts of modern circuitry. They’re used as semiconductors in virtually everything from healthcare machinery, TV and audio tech, PC data and processing through to industrial applications, aerospace and defence, telecommunications, and automotive manufacturing.

A recent scarcity of semiconductors has already hit manufacturers worldwide – but if demand once again outstrips supply, it could harm innovation and slow advances in technology. This wouldn’t just impede development but actively inhibit innovation on an international scale.

The European Commission is seeking to avoid this outcome with targeted investment in the European production of semiconductor chips – the so-called EU Chips Act – to the tune of almost €22 billion in funding.

Why is the investment in microchips important?

The worldwide supply chains of chips were heavily disrupted by COVID-19 lockdowns and labour restrictions, impacting manufacturing across virtually every industry.

In the automotive industry, which alone accounts for 10% of the global semiconductor market, every major manufacturing region was impacted by the backlogs of chip demand. The UK alone experienced a sharp 30% drop in production compared to pre-pandemic levels while registration of new cars across the globe plummeted by 25%.

The impact of semiconductor chip shortages saw an estimated 672,000 light-use vehicles produced in Q1 of 2021, even after restrictions had begun to ease.

This is just a brief insight into one industry; the global impact of the supply chain shortage was and remains significant.

According to research by Goldman Sachs, 169 industries worldwide were affected by the widespread microchip shortage. It’s a problem that has cost millions – and one that the EU Chips Act will address at the source.

What is the EU Chips Act?

The EU Chips Act is a piece of legislation that came into force on 25th July 2023, designed to encourage innovation in microelectronics and increase the EU’s share of microchip production to 20% in the next seven years.

Put simply, the EU wants to significantly increase the number of companies globally that have the capacity to create microchips in-house – which will ensure that manufacturers are insulated from supply chain problems like those experienced in 2020.

Linked to the Act is the vehicle to access the funding, otherwise known as the ‘Important Project of Common European Interest’ in microelectronics and communication technologies (or ‘IPCEI ME/CT’).

The Act and Project combine to create an immediate incentive for European companies to shift focus from externally sourcing vital parts of their machinery to producing them in-house – with the support to facilitate this and the funding to boot.

As well as the initial pledge of €8.1 billion in state aid, the move is also expected to unlock a further €13.7 billion in private investment across 14 member countries: Austria, Czechia, Finland, France, Germany, Greece, Ireland, Italy, Malta, the Netherlands, Poland, Romania, Slovakia, and Spain.

Due to how closely connected digital technology is with microprocessing, investing in semiconductor chips on this scale is hoped to yield dual benefits: it will not only safeguard existing production lines from unpredictable supply chain impacts but fundamentally drive the future development of the technology that the chips power. Technology such as AI, quantum computing, 5G and 6G communications, autonomous driving, and green technologies.

So far, 68 projects have been pledged across 56 companies, including global brands such as Vodafone, Infineon, Ericsson and GlobalFoundries.

Thermal imaging is essential for testing electronics

Whatever the scope of these ambitious projects and whether chips are being used to capture, process, store, or act on data directly, testing will be a vital step in the development process.

To get the most from the available funding, companies will need to be able to test their components to meet specific safety standards. Whether it’s testing functionality, performance or quality assurance, the electronic components will need to be carefully vetted.

Thermography plays a vital role in allowing manufacturers to monitor their circuitry to detect heat dissipation or thermal runaway as it develops.

Observing the thermal characteristics of their microchips in real-time will ensure that any issues with implementation or the compatibility of components are spotted and treated early – preventing costly downtime and shortening the design cycle to make it as efficient as possible.

For benchtop testing in industrial manufacturing environments, companies must ensure they invest in robust, dependable thermal imaging. Whether they’re perfecting discrete components like resistors and capacitors or elements that interface with power supplies such as transistors or transformers, thermal imaging systems such as the powerful FLIR A6700-series cameras or precise FLIR A8580 MWIR will be absolutely crucial.

Whatever companies across the EU focus their R&D budget on and regardless of the industry they apply their research in, thermography offers essential insights.

It enables testers to detect any trace damage from power surges or malfunctioning components at every stage of the development cycle – so it is an area that manufacturers should invest in shrewdly in the years ahead.