Electronic components distributor Q4‘20 performance

The COVID-19 pandemic continued to have a significant impact on the European Distributor Total Available Market (DTAM) in Q4’20. Consolidated returns from member companies in the International Distributors of Electronics Association (IDEA) reveal that average European ‘bookings’ improved significantly in Q4’20 when compared to the previous quarter but ‘billings’ continued to slide in the period.

According to Adam Fletcher, IDEA Chairman, despite the pandemic the Q4 performance broadly followed the historical trend for the final quarter of the year and is in-line with his members’ forecast: “Q4 is historically a weak quarter in European electronic components markets and a ‘billings’ decline of (10.3%) for the full year is probably not an unreasonable outcome given the turmoil in the overall European economy in 2020. As we move into 2021 IDEA members are now looking forward to entering a period of modest growth.”

Each month IDEA collates the statistical data reported by its member associations throughout Europe, which it then consolidates before publishing the figures as headline information. IDEA uses three primary metrics in its reporting process: ‘billings’ (sales revenue invoiced, less credits), ‘bookings’ (net new orders entered), and the ratio of the two known as the ‘Book to Bill’ (or B2B) ratio.

A positive B2B number - i.e. greater than 1 – indicates growth in electronic components markets but a number below 1 is evidence of a decline: “All three metrics are important, but the consolidated ‘billings’ number is possibly the most useful indicator for many organisations in the electronic components supply network,” said Fletcher. “The billings metric is the most accurate indicator of average sales revenue performance in Europe. Organisations are able to use this figure to compare their actual operating performance with the European average”.

The data presented in the following graphics is shown in K€ Euros and where necessary, has been converted from local currencies at a fixed exchange rate for the year.

Overall Q4‘20 bookings, billings & B2B trends

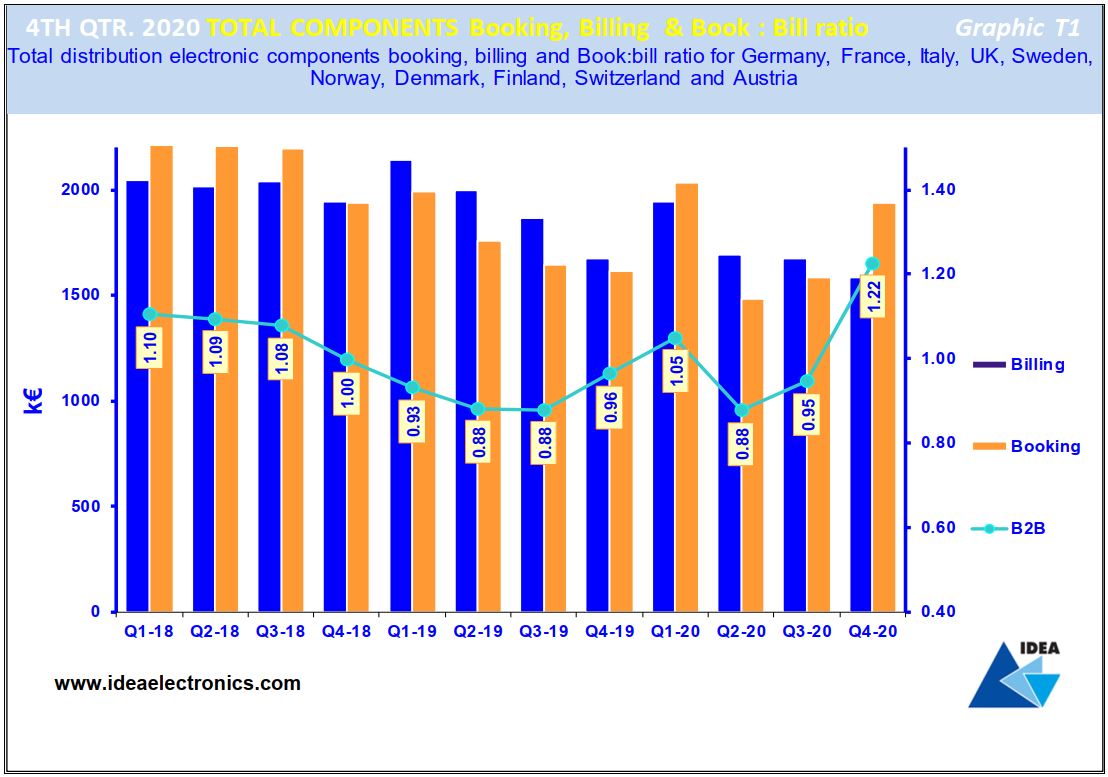

Graphic T1 is a visual representation of twelve quarters of consolidated European ‘bookings’ and ‘billings’, together with the corresponding ‘Book-to-Bill’ (B2B) ratios.

The chart reveals a big improvement in bookings in the fourth quarter of 2020 compared to the previous quarter but also shows a decline in billings of (five percent) in the same period. The B2B ratio improved from 0.95:1 to 1.22:1, well above unity. Q4’20 booking suffered a more significant decline of (ten percent) in Q4 compared to the same quarter the previous year.

In effect the market slowed in the last quarter of the year but despite limited visibility from their customers, OEMs continued to increase their order cover in response to the rapidly extending manufacturer lead-times,

European bookings improve significantly in Q4 ’20

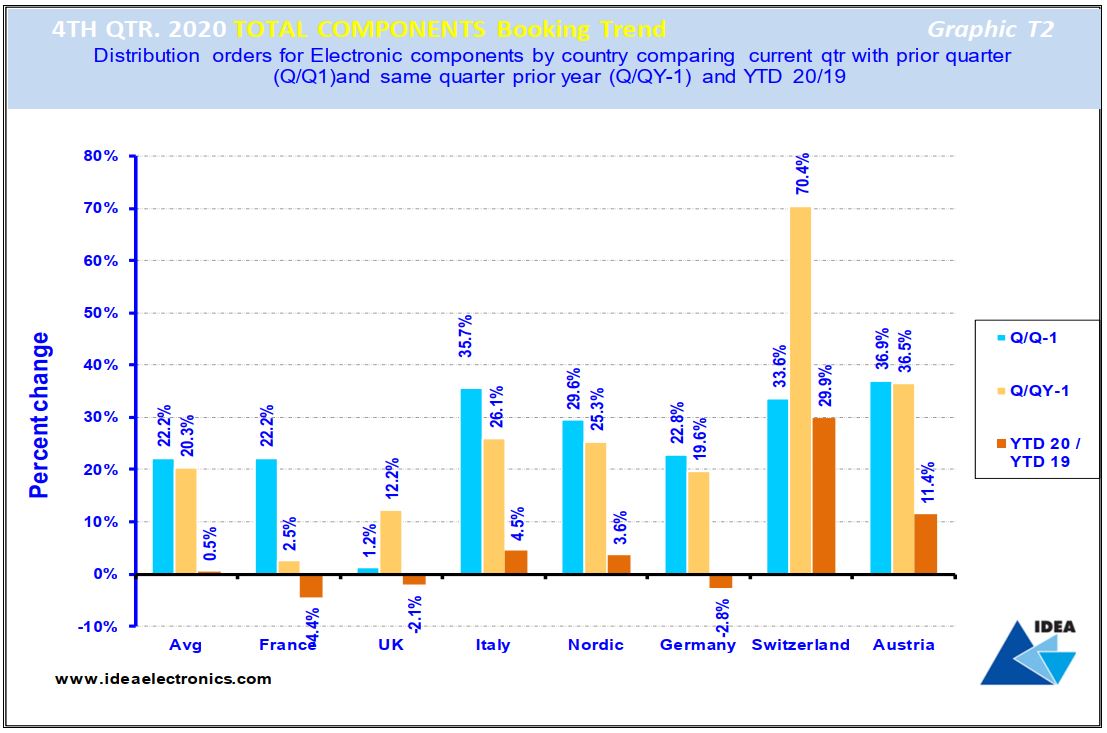

Graphic T2 compares the total electronic components ‘bookings’ result achieved in each European country in Q4'20 and contrasts and compares these figures with the results achieved in the previous quarter and those achieved in the same period last year.

The blue bar reveals that on average European ‘bookings’ increased by 22% in Q4‘20 when compared to the previous quarter.

The light brown bar compares Q4’20 ‘bookings’ figures achieved in each country with those achieved in the same quarter 2019 and indicates that on average ‘bookings’ grew by 20% in the period.

The dark brown bar compares average ‘bookings’ achieved in Europe year-to-date with the same period in 2019, revealing that the average bookings growth rate increased by 0.5% across Europe over the 12-month period. This performance strongly suggests a continuing weakness in customer demand across all European markets.

European billings decline in Q4 ’20

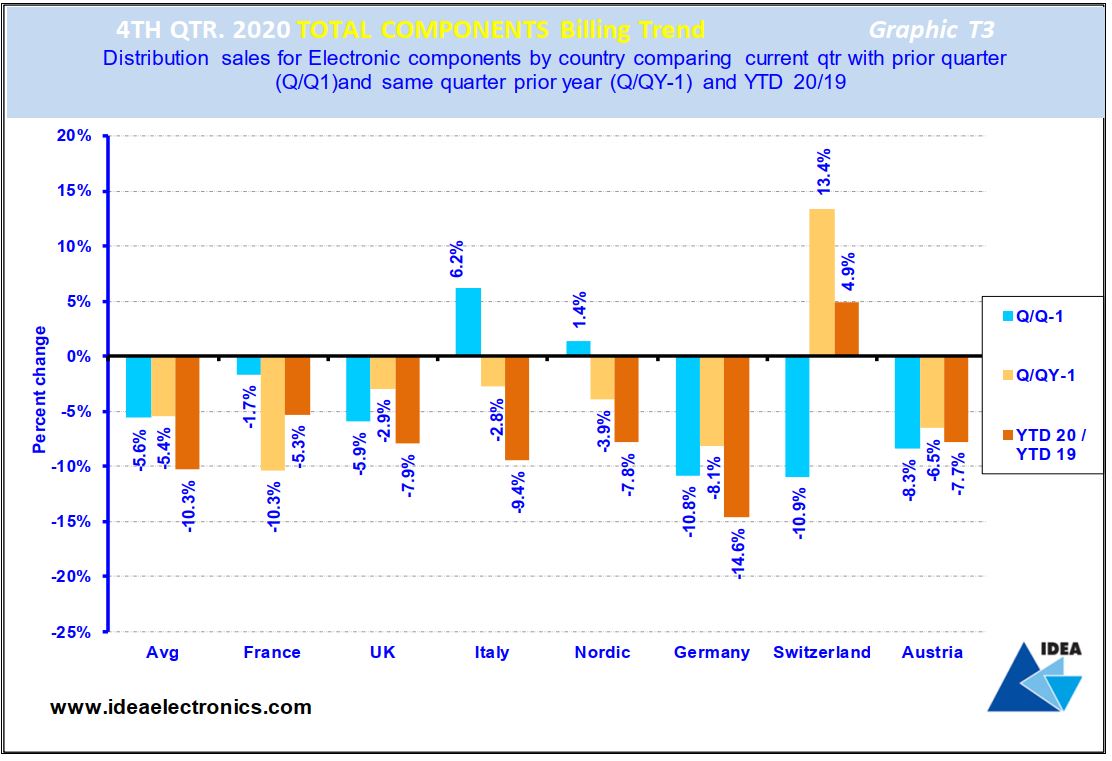

Graphic T3 illustrates total electronic components ‘billings’ achieved in European markets in Q4 ‘20 and contrasts and compares the figures with the previous quarter's results and those achieved in the same period last year.

The blue bars reveal that European electronic components markets experienced an average decline of (five percent) in Q4‘20 when compared to the previous quarter.

The light brown bars compare Q4‘20 with the same quarter 2019 and shows that European electronic components markets suffered an average decline of (five percent) in the quarter.

The dark brown bars compare current YTD ‘billings’ with the same period 2019, revealing an average decline of (ten percent) across all European electronic components markets. Even given the global pandemic this is a disappointing result, but IDEA members have become adept at trading in adverse conditions.

They remain hopeful that the low point in the current economic cycle has been reached and are optimistic that growth will return to the European electronic components supply network in 2021, despite the slow roll out of the EU’s COVID-19 vaccination programme.