Growing demand for budget air travelling impels the addition of aircrafts to commercial fleets. Since aviation connectors are crucial to the functioning of aircrafts, manufacturers will witness an increase in revenues. The global aviation connector market will grow at a steady 5% CAGR during the forecast period (2020 – 2030). Major players are prioritizing countries with air-force projects in the pipeline.

Strategic partnerships with airplane manufacturers continue to be a popular growth strategy. Amid the COVID-19 Pandemic, production, and distribution channels are witnessing a steep decline in operations. However, preventive government strategies to recover the economic loss of COVID-19 will present gainful opportunities through 2030.

Key takeaways

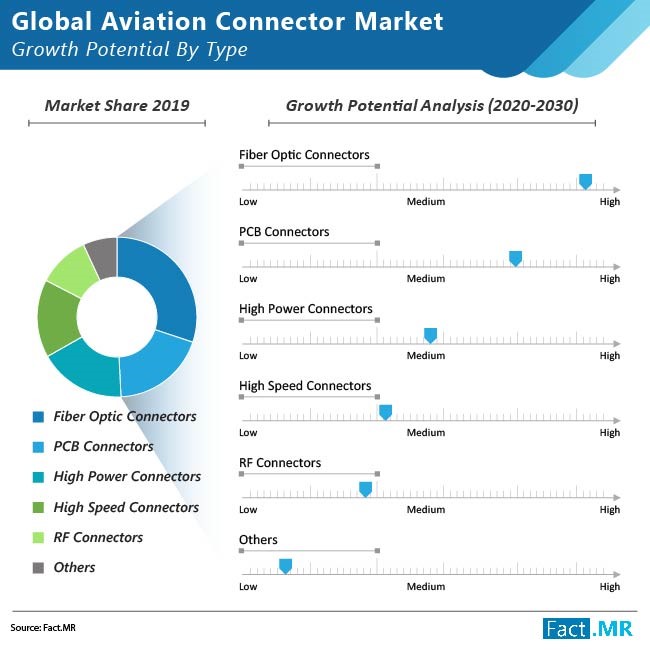

- Fiber optic connectors are the most remunerative product type with more than 30% share of the total market value. Upgraded safety features, and prominence of in-flight entertainment are main drivers of demand for this product type.

- High speed connectors offer lucrative growth opportunities with an impressive 6.5% CAGR through 2030. The need for increasing data transmission speeds to cater to an exponential increase in air traffic drives the demand for high-speed connectors.

- Circular shaped connectors exhibit share-wide dominance accounting for over 66% share of the total market value. Prevalence of circular geometry in aircraft parts and propulsion components are central to growth in this segment. ‘

- Rectangular aviation connectors are an upcoming category that match the new designs of modern aircrafts. The shape segment will continue to capture market share at ~6% CAGR through 2030.

- Commercial end-use generates maximum revenues for manufacturers with over 56% share of the total market revenue. Multiplying customers on the back of increasing disposable income and hectic work life drive the demand for commercial aircrafts and the resultant demand for aviation connectors.

- Global success of start-ups propel the investments of high-net worth individuals in business jets. The business jets end-use segment is a high-growth segment with the highest CAGR of 6.3% from 2020 to 2030.

- North America and Europe, together account for over 39% share of global sales. Presence of prominent manufacturers coupled with aviation technology advancements is the root cause of this market share.

Organic growth strategies will speed recovery amid COVID-19

Organic growth strategies such as market penetration, product development, and diversification will be top trends among market players. Markets in low COVID-19 impact countries will be the first ones to offer revenue opportunities. A prime concern for manufacturers is the impact of COVID-19 and resultant social-distancing trends on air travelling. It is expected that consumer adoption of close proximity transportation through airplanes, buses, and other public transport will be slow.

Current limitations on import and export between countries presents a tricky challenge for manufacturers. Procurement of raw materials, dearth of workforce, and lack of logistics support are a few important challenges the COVID-19 pandemic imposes on aviation connector manufacturers during the forecast period. However, recovering countries suggest some relief may be underway, as the spread of coronavirus comes under control in the following months of the second financial quarter of 2020.

Some of the major competitors operating in the aviation connector market are Amphenol, Bel Fuse, Carlisle Companies, Conesys, Eaton, Fischer Connectors, ITT, Rosenberger, Smiths, TE Connectivity and others.