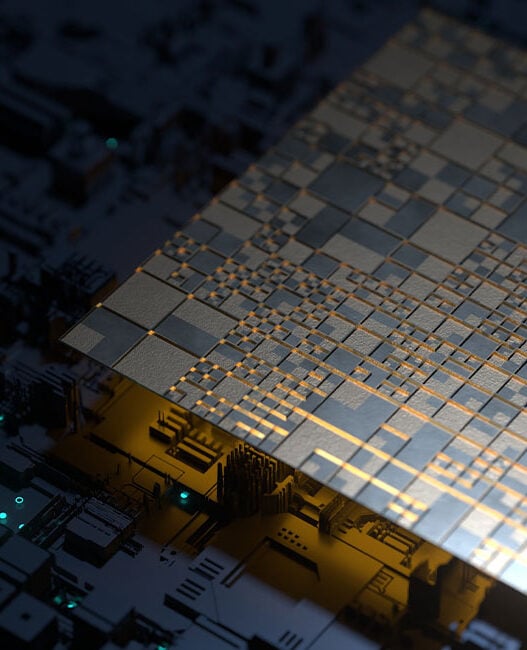

The firm’s revenue doubled last year, exceeding $60bn, with CEO Jensen Huang noting a global surge in demand for Nvidia’s chips. Initially famed for its graphics processing units, Nvidia has now ascended to the fourth spot among the world’s most valuable publicly traded companies, trailing only behind giants like Microsoft, Apple, and Saudi Aramco.

Nvidia’s transition to AI-centric operations has been fruitful, with its chips becoming integral to a variety of AI applications across multiple sectors. The value of Nvidia’s shares has tripled over the past year, showcasing strong market confidence in its AI-focused business model. The company’s valuation boost also spurred a broader market rally, reinforcing the AI boom’s credibility.

Amidst its financial and market achievements, Nvidia has faced challenges, notably from the US government’s recent directives to halt shipments of certain AI chips to China. Initially slated for implementation 30 days post-17 October, this decision by the Biden administration aims to prevent countries like China, Iran, and Russia from acquiring high-end AI chips, affecting Nvidia and other manufacturers. Despite the immediate imposition of these restrictions, Nvidia reported to the SEC that it doesn’t anticipate a significant near-term financial impact, citing robust global demand for its products.

Chinese officials have yet to respond to Nvidia’s announcement, but China previously criticised the US’s chip export restrictions as contrary to market economy principles and fair competition.

This strategic move by the US is seen as a measure to mitigate vulnerabilities exposed by initial chip control efforts last October, aimed at denying China access to advanced technologies that could enhance its military capabilities, especially in AI. China, however, hit back with news they have created a chip ACCEL that 3,000 times faster than Nvidia’s A100 in specific tasks by using light-based technology.

Despite this and other regulatory hurdles, Nvidia’s AI chips remain in high demand, significantly driving its share prices and consolidating its position as a leading entity in the AI space. In May 2023, Nvidia joined the elite “Trillion dollar club,” featuring tech giants like Apple, Amazon, Alphabet, and Microsoft, all valued over $1 trillion, and this latest valuation makes Nvidia the fifth publicly traded company to ever surpass $2tn. Equally, the day after its earnings report released last Thursday, the increase in value – $277bn – mark Wall Street’s largest one-day gain in history.

As the AI chip market continues to evolve, with innovations like the ACCEL chip challenging traditional tech hegemonies, Nvidia’s strategic partnerships, such as with Foxconn to develop “AI factories,” and its robust market performance, position it to navigate both opportunities and challenges in the rapidly advancing tech landscape.