Since the need to have a continuous supply of electricity is increasing at a tremendous rate every year, governments across the world are enforcing strict rules and regulations. These laws are aimed at ensuring responsible use of energy sources while also urging organisations to adopt renewable sources of energy to fulfill their electricity demand.

Electricity networks are being upgraded and innovative technologies, such as AI and IoT are being used to increase the efficiency and performance levels of these systems. Concepts like digitisation of the energy infrastructure are gaining momentum in many regions across the world. Once the networks are digitised, it becomes much easier for the end-users to monitor their daily electricity consumption. It can help them find effective ways to conserve energy.

Below is an in-depth insight into the regional trends that will strengthen power transformer market potential over 2021-2027:

- Europe:

Closed core power transformers gain traction:

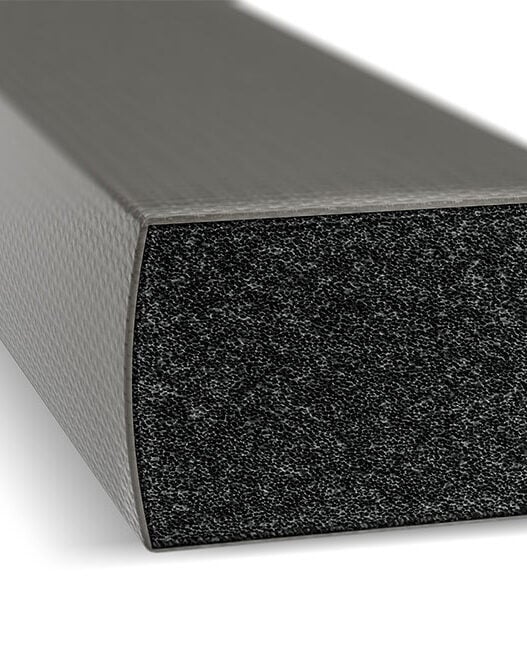

Closed core power transformers will hold a major share of the Europe power transformer market by 2027 as urbanisation is picking up the pace. This has resulted in a hike in the demand for a strong system that offers uninterrupted energy supply. Government reforms are becoming favorable to encourage the adoption of power transformers across the residential sector.

Moreover, the existing electricity transmission networks are being replaced with advanced ones to enhance energy saving and closely monitor the overall electricity consumption. This will foster the use of closed core power transformers.

Rising installation of power transformers across outdoor spaces:

The regional power transformer industry size from outdoor installation will increase at a steady rate over 2021-2027. Government policies are becoming strict to ensure high sustainability of grid networks and implementation of smart monitoring systems.

Power transformers, when installed in outdoor spaces, have a variety of robust uses in high voltage application areas and require lesser materials. The deployment of cross-border electric networks will boost the installation of power transformers in outdoor spaces.

Less than 100 MVA rated power transformers used in real estate:

Power transformers with less than 100 MVA rating will be widely used in the regional real estate sector as there is a rising need to refurbish the aging buildings. Since the real estate industry is growing at an appreciable rate, the governments are increasing their investments to develop an advanced electric infrastructure. Commercial complexes, such as hotels, resorts, malls, and universities are being built on a large scale, thereby increasing the installation of these transformers.

- Asia Pacific:

High adoption of shell core power transformers:

Shell core power transformers are expected to hold a significant share of the Asia Pacific power transformer market by 2027. Low voltage power circuits are being extensively installed in high voltage networks at various critical nodes. These transformers have a compact design, are highly reliable, can be easily transported, and give high electricity output, thereby augmenting their use.

Auto transformers widely used to monitor voltage rate:

The regional industry size from auto power transformers will register a high CAGR through 2027. These transformers are capable of improving the voltage capacity and can decrease the core losses. They are lightweight, compact, and incur low product cost. The increasing deployment of smart and hybrid monitoring systems will bolster the use of auto transformers in the region.

Use of air-insulated transformers for sustainable power generation:

Air-insulated transformers will be highly demanded by end-users across the region as they have a wide range of applications. They facilitate an efficient operation of the energy networks and offer grid sustainability by reducing the chances of internal failures.

- North America:

The U.S. power transformer market share is projected to amplify due to the rising need for electricity in mining, petrochemical, and cement manufacturing sectors. Government reforms formulated for the public and private companies with respect to electricity supply are becoming stringent. For example, WEG set up its fifth power generation plant in the U.S. in 2021, to increase the production of power transformers, thereby fueling their sale.

Power transformers find high deployment across indoor spaces:

The regional power transformer market outlook from indoor installations will improve as the customers are increasingly demanding a reliable energy infrastructure. Cutting-edge technologies like automation are picking up the pace and captive energy sources are being extensively integrated in the industrial sector, increasing the installation of power transformers in indoor spaces.

The global power transformer market forecast will be positively impacted by the growing demand for electricity across the developed and developing regions as many countries are witnessing a robust increase in industrialization and urbanisation.

Reputed organisations, including Hitachi ABB, Siemens, Eaton, General Electric, Toshiba, Mitsubishi Electric Corporation, and Hammond Power Solutions, among many others are producing two-winding and auto transformers, which will be widely installed across indoor and outdoor spaces. The firms are introducing various cooling and insulation methods for three-phase and single-phase transformers.