5G is paving the way for a fully digitalised and connected world. The past two years have seen many new field trials and an accelerating number of commercial rollouts. Moreover, 5G is starting to be adopted in a wide range of industries, from manufacturing to healthcare.

With high throughput and ultralow latency, 5G can tap into many high-value areas including 3D robotic control, virtual reality monitoring, and remote medical control that previous technologies were not able to address. 5G is redefining and accelerating industries, such as automotive, entertainment, computing, and manufacturing, and will ultimately change the way people work and live.

IDTechEx has been researching 5G-related topics for many years, and has released its most recent version of the 5G market research report: ‘5G Technology, Market and Forecasts 2022-2032’. ’The analysis investigates the key technical, industrial, and regional aspects affecting the rapidly expanding 5G market.

The 5G deployment outlook in five key regions

5G refers to a set of improved and updated mobile communication technologies, alongside new characteristics that arise from new frequency bands: 3.5 to 7 GHz (also known as sub-6 GHz) or over 24 GHz (also known as mmWave), as well as larger bandwidths. This is why 5G can tackle the multiple challenges that its predecessors could not.

According to IDTechEx’s research, 56% of 5G commercial services in the globe operate in the sub-6 GHz range. Almost all the base stations in the sub-6 GHz spectrum are in cities.

See Figure 1 for the network rollout strategy used by telecom operators to build their 5G network, showing that higher frequency bands will be used largely in densely populated regions. Figure 2 provides a rundown of the percentages of commercial/pre-commercial services by frequency (from low band to mmWave).

Figure 1: 5G network deployment strategy, from IDTechEx’s ‘5G Technology, Market and Forecasts 2022-2032’ report.

Figure 2: 5G commercial/pre-commercial services by frequency (2021), from IDTechEx’s ‘5G Technology, Market and Forecasts 2022-2032’ report.

Each country (or region) has its unique release schedule for spectrum. Even though most nations issued the sub-6 GHz spectrum initially, there are few outliers. The US regulatory agency, for example, issued the mmWave spectrum first and only released its sub-6 GHz band in early 2021.

As a result of the above, each country’s 5G rollout forecast and deployment strategy will differ. IDTechEx’s 5G report includes a detailed regional analysis of 5G deployment status and future rollout roadmap in five key regions: the United States, China, Japan, South Korea, and Europe, including governmental strategy, funding, and key national telecom operators’ 5G rollout schedule and roadmap, as well as revenue analysis.

mmWave and Open RAN (Radio Access Network)

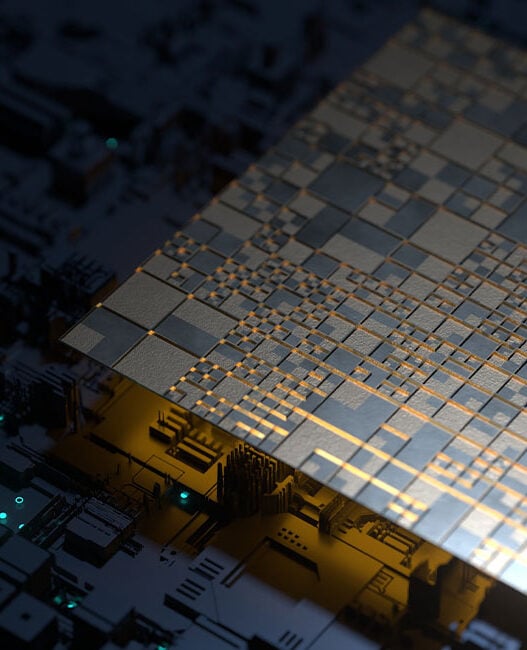

mmWave, which was previously only used for military, satellite, and automotive radar communication purposes, has recently been introduced to the frequency pool for mobile communications – enabling a maximum data throughput of 20Gbps with an ultralow latency of 1 millisecond. Such a high frequency necessitates the development of new materials as well as new device designs.

Low-loss materials with a minimal dielectric constant and tan loss, for example, as well as advanced packaging solutions, are required for mmWave devices to prevent excessive transmission loss. Because of the short wavelength of mmWave communications, the device is becoming increasingly compact and integrated, making power and thermal management more vital still.

In this report, IDTechEx assesses the technical pain points and explores the trends and innovations for both 5G materials and design to overcome these bottlenecks. Furthermore, the report also provides a thorough overview of the 5G mmWave industry, a review of key players, a supply chain analysis, and a look at the vertical applications made possible by mmWave technology.

The deployment of 5G infrastructure is of course critical to enabling widespread 5G adoption. Legacy telecom system vendors such as Huawei, Ericsson, and Nokia hold a large share of the 5G infrastructure market, according to IDTechEx, with Huawei dominating with 36% in 2020, followed by Ericsson with 27%.

Telecom operators are pushing for the development of Open RAN (Radio Access Network), which refers to the use of networks that are based on disaggregated RAN components with standardised interoperability, including the use of non-proprietary white-box hardware, open-source software from different vendors, and open interfaces. This focus on Open RAN exists to eliminate the proprietary nature of RAN systems, diversify the vendor supply chain in the telecom industry, bring more innovation, reduce the cost of RAN deployment (especially given that the cost of 5G deployment is more expensive than 4G), and reduce the cost of operation.

A few top telecom carriers have already launched small-scaled Open RAN 5G networks as early as mid-2021. And many more have laid out plans to deploy 5G networks in the future using Open RAN technology.

The above points and more – such as questions about the cost, strategies, and challenges of Open RAN – are covered in IDTechEx’s report. For more information, visit www.IDTechEx.com/Research/5G.