In working to strengthen the company’s earnings base, since the merger on April 1, 2010 Renesas has been pursuing integration synergies, and building on its dominant number one position worldwide in the microcontroller market by optimizing our business portfolio and streamlining the manufacturing structure among a range of other such measures. Steady implementation of these measures has produced tangible results, including an approximate 20% reduction in fixed costs in the last two years.

However, after considering the impact of the 2011 Great East Japan Earthquake, along with the impact of global economic uncertainty, Renesas determined that further measures were necessary to respond to dramatic changes in the global economic circumstances and domestic operating environment. Accordingly, following an announcement on July 3, 2012, Renesas has been implementing additional business and structural measures, centered on an early retirement incentive program and significant restructuring of domestic production sites.

The early retirement incentive program, as outlined in Renesas’ announcement of October 16, 2012, received 7,446 applications, and all applicants retired as of October 31. The restructuring of domestic production sites has been proceeded as planned, including an agreement to transfer Renesas High Components (Aomori Factory) to AOI ELECTRONICS CO., LTD. as announced on October 12, 2012. Renesas intends to continue efforts to create a lean organization and management structure, and under the current management framework the company is planning to pursue further rationalization initiatives to boost competitiveness, including further optimization of the personnel structure.

In terms of strengthening the company’s financial foundation, on September 28, 2012 Renesas announced new financing totaling 97 billion yen from major shareholders and main banks. Renesas also entered into an agreement for a syndicated loan totaling 161.1 billion yen, arranged by the main banks, which allows the company to convert short-term debt to long-term debt and secure stable long-term funding. Through these initiatives Renesas has secured sufficient funding for the foreseeable future to enable implementation of ongoing structural reforms.

Today, as detailed in a press release titled “Renesas Electronics Announces Share Issue through Third-Party Allotment, and Change in Major Shareholders, Largest Shareholder who is Major Shareholder, Parent Company and Other Related Companies”, Renesas announced a decision to issue 150 billion yen in shares through third-party allotment to The Innovation Network Corporation of Japan (hereinafter “INCJ”), Toyota Motor Corporation, Nissan Motor Co., Ltd., Keihin Corporation, Denso Corporation, Canon Inc., Nikon Corporation, Panasonic Corporation and Yaskawa Electric Corporation, with the aim of establishing a financial foundation resistant to rapid changes in the global economy and domestic business environment and investing in core business areas for growth to enable a recovery in performance. Details of the third-party allotment are available in the aforementioned press release.

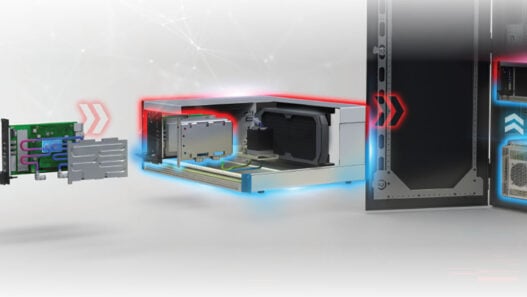

In the emerging Smart Society brought about by the increasing pace of network connectivity in electronic equipment and social infrastructure, control systems that embed MCUs and IT equipment using SoCs are rapidly converging. Therefore, the new market for control systems based on MCUs is expected to expand. As this transition progresses simultaneously in advanced and developing countries, an extremely large new market will be created for the semiconductor industry to exploit. By strengthening its earnings base and financial foundation, Renesas aims to respond to these changes in the market and construct high value-added MCU-based kit solutions for customers with further strengthened Analog and Power semiconductors, which are essential to the kit solutions, while improving its competitiveness in SoCs. Renesas will realize growth in this new market by supplying platforms that combines these kit solutions with software including IPs and OS commonly used for each application, contributing to shorter development periods, increased cost competitiveness and productivity for customers.

Renesas plans to use funds raised from this capital increase by third-party allotment to realize its goal of growth in the Smart Society through investment in the five areas outlined in the table below. Based on this, Renesas seeks to ensure sales growth in these strengthened areas, and achieve stable profits, while increasing corporate and shareholder value.