Q110 BOOSTCAP ultracapacitor revenue increased by 79 percent, to $13.8 million, compared with $7.7 million for the same period last year. Sales of high voltage capacitor and microelectronics products totaled $12.8 million for Q110, down 13 percent from the $14.7 million recorded in Q109.

Ultracapacitor sales growth continues to be driven primarily by increasing demand for energy storage and power delivery systems for hybrid transit buses and wind turbines, and we are now seeing a more meaningful contribution from various backup power applications, said David Schramm, Maxwell’s president and chief executive officer. Increasing volume and improving efficiency enabled the company to generate cash from operations in Q1 for the third time in the past four quarters.

Growing environmental consciousness at the consumer level and government mandates and subsidies for reduced emission public transit, commercial and passenger vehicles and emission-free renewable energy from wind turbines are driving increasing demand for efficient, reliable, cost-effective ultracapacitor-powered solutions, Schramm added. Based on strong current bookings and order activity, we expect sequential ultracapacitor sales growth in the second quarter, and that higher volume, along with improving overall gross margins, should move us closer to our goal of profitability at the operating income line.

Cash and restricted cash totaled $38.1 million as of March 31, 2010, compared with $37.6 million as of December 31, 2009. Q110 gross margin was 38 percent, compared with 31 percent in Q109 and 34 percent in Q409. Operating expenses totaled approximately $11.8 million, or 44 percent of revenue in Q110, compared with $8.8 million, or 39 percent of revenue in Q109. Complete financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations will be available with the filing of the company’s Quarterly Report on Form 10-Q with the Securities & Exchange Commission.

As previously disclosed, the Company has been conducting an inquiry into the nature of payments made to a former independent sales agent in China associated with sales of high voltage capacitor products produced by Maxwell’s Swiss subsidiary. The Company has been voluntarily sharing information with the Securities and Exchange Commission and the Department of Justice, and discussions with those authorities are ongoing. For accounting purposes, under U.S. Generally Accepted Accounting Principles (GAAP), based on the company’s estimate of a potential settlement range of $9.3 million to $20.0 million, the company recorded an accrual of $9.3 million in Q409.

Management will conduct a conference call and simultaneous webcast to discuss first quarter financial results and the future outlook at 5 p.m. (EDT) today. The call may be accessed by dialing toll-free, (800) 895-0198 from the U.S. and Canada, or (785) 424-1053 for international callers, and entering the conference ID, 7MAXWELL. The live web cast and subsequent archived replay may be accessed at the company’s web site via the following link: http://maxwell.investorroom.com/.

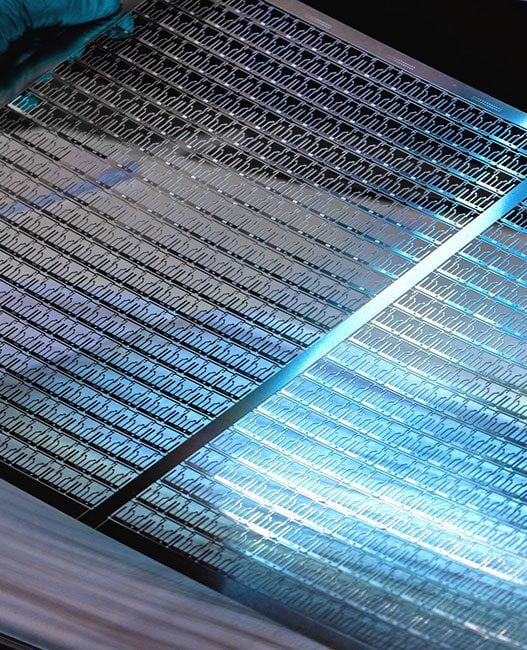

Maxwell is a leading developer and manufacturer of innovative, cost-effective energy storage and power delivery solutions. Our BOOSTCAP® ultracapacitor cells and multi-cell modules provide safe and reliable power solutions for applications in consumer and industrial electronics, transportation and telecommunications. Our CONDIS® high-voltage grading and coupling capacitors help to ensure the safety and reliability of electric utility infrastructure and other applications involving transport, distribution and measurement of high-voltage electrical energy. Our radiation-mitigated microelectronic products include power modules, memory modules and single board computers that incorporate powerful commercial silicon for superior performance and high reliability in aerospace applications.

Statements in this news release that are forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors such as:

* the company’s history of losses and uncertainty about its ability to achieve or maintain profitability, or to obtain sufficient capital to finance its operations;

* disruption of global financial markets and reduced availability of credit;

* general economic conditions in the markets served by the company’s products;

* development and acceptance of products based on new technologies;

* demand for original equipment manufacturers’ products reaching anticipated levels;

* cost-effective manufacturing and the success of outsourced product assembly;

* the impact of competitive products and pricing;

* risks and uncertainties involved in foreign operations, including the impact of currency fluctuations;

* product liability or warranty claims in excess of reserves.