Innovation in MEMS stays very active

Innovation in MEMS no longer comes solely from new devices, but also from the integration of mature MEMS technologies into new applications. Along with mature devices used for new applications (e.g. pressure for LBS), innovation in new MEMS devices is still active and will continue

to strongly participate to the MEMS market growth in the next 5 years. This Yole Développement report on emerging MEMS looks at the new MEMS technologies that, as a group, are expected to represent almost 10% of the value of the general MEMS market by 2018. The market will be mainly driven by medical applications – especially pharmaceutical research through DNA sequencing – and by consumer applications through innovations in mobile phones. Most of this growth is expected to take place after 2015, once products have been qualified and are suitable for volume manufacturing.

Emerging MEMS challenge: Dream vs. Reality

The dream:

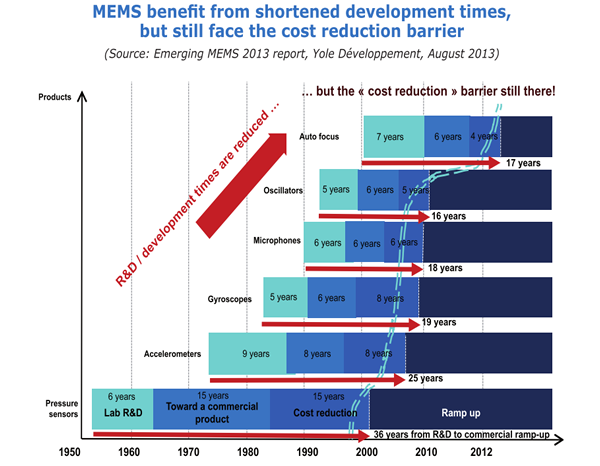

After several decades of commercial existence, MEMS devices can now rely on a solid foundation for new developments. The time from R&D to commercialization has shrunk over the years, from 21 years for pressure sensors back in the 60’s to 11 years for oscillators. MEMS devices have been successful in fields with very high volumes, and have been proven capable of generating big profits. When you look at MEMS devices, you think about large volumes, and inexpensive devices; all aiming at the golden nugget that is the consumer market. This is where emerging MEMS devices try to go!

The reality:

An important barrier still exists for new devices: the cost reduction step before commercial ramp up. Most of the emerging MEMS companies are fabless start-ups that rely on the large worldwide MEMS foundry capabilities. These start-ups with new MEMS-based devices such as micro speakers, autofocus or micro-fuel cells aim at the consumer market for their commercial entrance. But this is without going through the usual “small volumes” phase in niche markets that can enable progressive cost reduction and product maturation. Those companies now face a great challenge: the price pressure of the consumer market.