Continued investment in sapphire for display covers?

Last month, Yole Développement released its annual sapphire industry analysis: Sapphire Applications & Market 2015: from LED to Consumer Electronic. This report discloses the status of the sapphire market evolution including the recent capacity expansion plans, especially in China. Yole’s analysts reveal a comprehensive 2014 wrap-up of the winners & losers and a special focus on the sapphire display covers application. Under this new sapphire report, Yole highlights the continuous flow of investing activities in sapphire display cover supply chain.

Eric Virey, Technology & Market Analyst, Yole Développement, commented: “Apple will represent 20% of 2015 global sapphire consumption with its iPhone and watch sapphire components. But Lens Technology recently announced plans to raise $942m and invest $532m of the proceed to further increasing sapphire growth and finishing capacity."

In 2014, Apple, its partners and their suppliers spent close to $2bn to set up a sapphire display cover supply chain. GTAT built and installed 2,135 ASF furnaces, Biel and Lens deployed close to 200 wire saws and 1,000s of finishing tools and ancillary equipment. But the projects faced many problems and Apple eventually gave up on sapphire for its iPhone 6. Reasons were multiple but can be summarised as “too much, too early & too fast”. The project was ambitious in its timeframe and targeted outputs while many of the necessary processes and technologies in crystal growth and finishing were still at an early stage of development. But the venture still set the stage for the future: the partners have developed an unrivalled expertise on how to work with sapphire in high volumes and cost controlled environment. A lot was also learned with the manufacturing of the complex 3D shaped Apple Watch cover. But the question remains: why use sapphire?

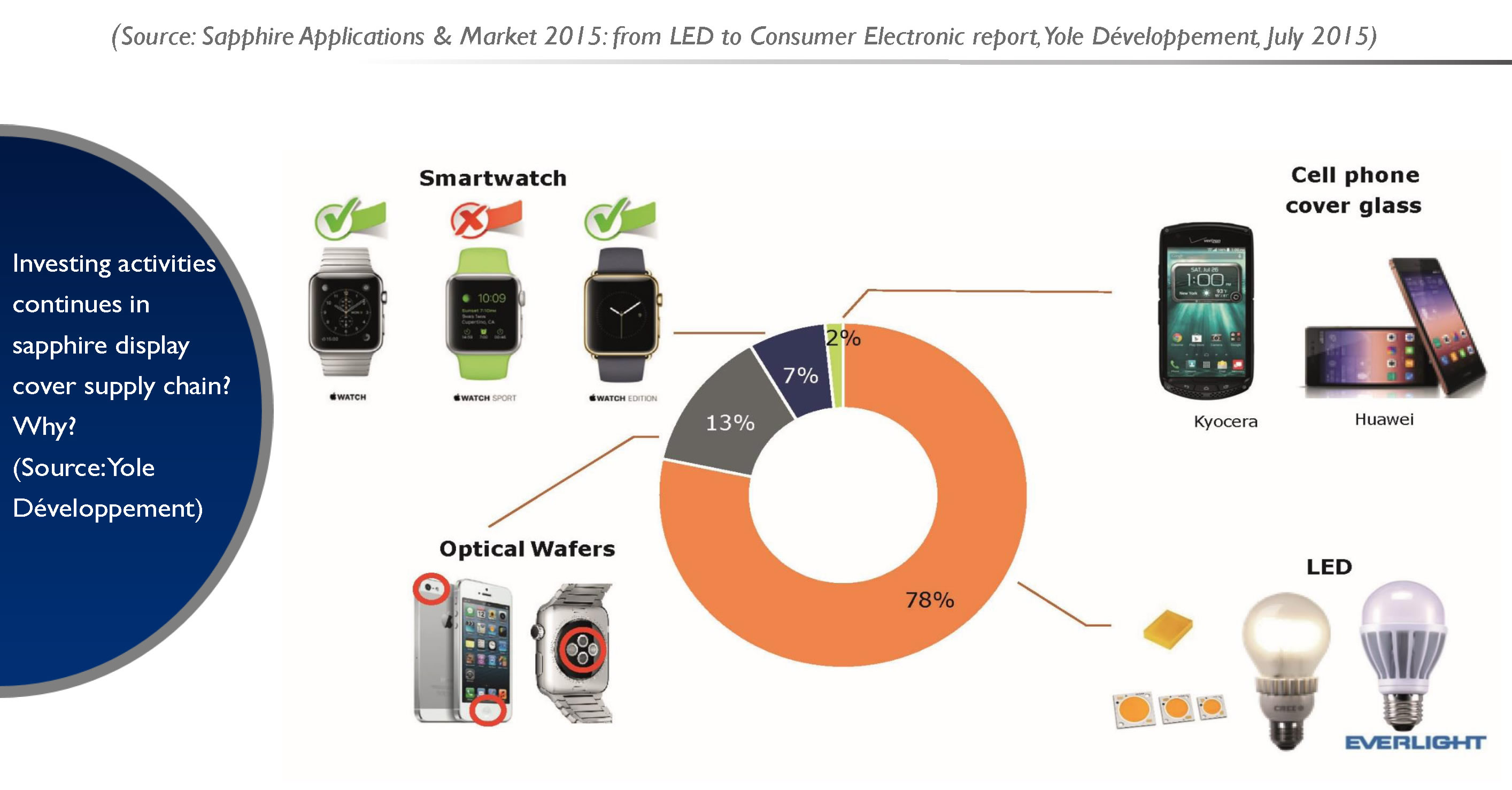

2015 material consumption breakdown per application

At more than five times the cost of glass, benefits in term of breakages are still far from obvious and high reflectivity washes out displays. Sapphire won’t sell for a premium and increase Apple market share just on glamour and cachet. If the company eventually adopts sapphire, it means that it would have either demonstrated that it can improve breakage resistance vs. glass and/or developed entirely new functionalities enabled by some unique properties of sapphire. To exist and thrive, the display cover market needs Apple to take the lead and to succeed. Beside them, only Huawei seems in a position to lift this market up but not at the same level. Alternative technologies are emerging: various OEMs recently adopted alumina coated glass display covers to provide their phones with superior scratch resistance.

Yole’s analysis as well as the vision of the key players of the sapphire industry will be presented next week at the 1st International Forum on Sapphire Market & Technologies, powered by Yole Développement and its partner CIOE. The Yole & CIOE conference will take place in Shenzhen from 31st August to 1st September.

“Yole and CIOE will welcome more than 160 participants next week in Shenzhen. At Yole, we are very pleased to have such a wonderful attendance and we enjoy discovering high added-value analysis, feedbacks, and success stories from key sapphire players. Make sure you will be part of this event: registration is still possible!” says Jean-Christophe Eloy, President & CEO, Yole Développement.