Aiming to provide complete sensor solutions

On a recent visit to its headquarters, Electronic Specifier Editor Joe Bush, caught up with ams CEO, Alexander Everke to get an update from what has been an interesting few years for the sensor specialist.

Sensors are key to every part of the digital transformation landscape, whether that is our own personal health or Industry 4.0. With this in mind, in 2015/16 ams decided to focus the company purely on sensors. Everke commented: “This was a major decision for the company as we were engaged in a number of other fields. However, we decided we wanted to become the leading sensor solutions company in the industry and to achieve this, major changes were required.

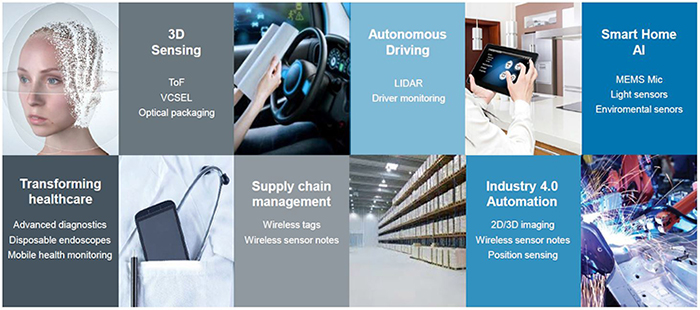

“Any megatrend that is part of the digital transformation in the market today is connected to sensors. This gives us a very strong outlook for our growth potential as any new application that is hitting the market has to be linked to sensors.”

The whole strategy at ams is focussed on differentiation whether that’s lower power, smaller form factor, higher sensitivity or multi-sensor integration. The company is addressing all vertical sensor segments, which it has split in two – consumer and communications (C&C), which made up around 50% of revenue in the first half of this year; with the other 50% being in automotive, industrial and medical (AIM). “This is very important as we want to address all vertical markets, have a balanced portfolio and not be too dependent on one market which may be too volatile,” Everke added.

He went on to discuss the company’s ambitious growth plans. “We’ve experience growth of 22% in first half of 2017 compared to the first half of 2016, but this is just the beginning of our growth story. If you compare Q2 2017 with Q2 2016 we have experienced growth of 37%. And we are looking at growing the company by 40% on a yearly basis – that’s the goal and we feel that we are going to achieve this very comfortably.”

Within all the sensor megatrends in the industry, whether it’s audio, 3D sensing, proximity, smart flow metering, bio-sensors, Everke believes that ams has a very unique position within those markets and technologies.

“As I’ve said, we took the decision to focus the company on sensors, but sensors is a broad field of products and technologies. So, we decided to focus the company on four pillars – optical sensors, imaging, environmental and audio. Why is this important? Well the rest of the semiconductor industry is currently looking at single figure growth, whereas the markets we are addressing are expected to grow at around 20%. So we have a portfolio that addresses the fastest growing segment in the semiconductor industry and we have the capability, due to our differentiation and product portfolio, that we can grow at least two times faster than any competitor.

“The other reason why our focus segments are so important, is because these are also markets that are not only growing faster, but the margin profile is more attractive. Why? Because in those sectors you can still improve your performance via technology and innovation. In other sensor areas innovation is already at the edge and there is less potential for differentiation. Our focus areas are still developing, so you can differentiate your products with better technology and this creates a more unique portfolio.

“We have different competitors in each of these segments but none of them have all four pillars. So if you look three to five years ahead you will see applications where you have combined solutions across all four pillars. So, a company that doesn’t have all four pillars will not be part of this growth. So we are aiming for the number one position in these four areas and then being able, over time, to offer combined, integrated solutions which no other competitor can support.”

Everke stressed the importance of differentiation as the key to the company’s strategy, whether it’s offering a complete solution to its customers, including software, or offering innovation and technologies that no one else has.

However, it was not possible to achieve this level of differentiation via organic investment alone. This is why the company has been involved in a significant amount of merger and acquisition activity over the past few years, starting in 2015 with the acquisition of the environmental business from NXP, which was the foundation of the company’s environmental pillar. Since then there have been several other high profile acquisitions including the company’s largest, which was in January this year, in the form of optical packaging leader Heptagon.

“We’ve been very active in M&A activity and we certainly won’t be stopping here. Every acquisition we have completed is not to acquire revenue, it is to acquire differentiated technology. We are looking purely for technology that no one else has and that enables us to offer complete solutions to our customers, and this is the way that we see that our company can grow.

“Our acquisitions have been bold. We are not a company that adopts a wait and see strategy – we react. Go big or go home and it’s this approach that has enabled us to position ourselves perfectly.”

Focused ams acquistions in 2015

- July 2015 - NXP Monolithic Environmental CMOS Sensors

- December 2015 - CMOSIS - image sensors targeting growth markets inclduing Industry 4.0, IoT and medical diagnostics

- June 2016 - CCMOSS - leading gas and infrared sensing

- July 2016 - MAZeT = strengthening spectral sensing portfolio

- December 2016 - Incus Laboratories - strengthening ANC portfolio

- January 2017 - Heptagon - high end optical packaging

- July 2017 - Princeton Optronics - enhancing 3D sensing, AR/VR and automotive applications