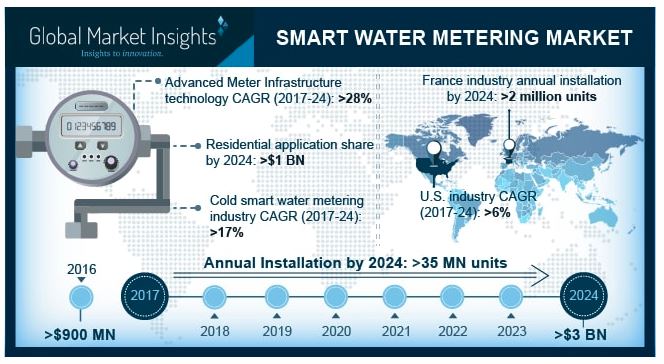

Smart water metering market to exceed $3bn by 2024

Adequate measures toward monitoring Non-Revenue Water (NRW) coupled with effective mapping of water resources will boost the smart water metering market. Increasing efforts to improve the efficiency of water networks and adequate addressing of unbilled water consumption will further enhance the business landscape.

For instance, according to International Energy Agency (IEA), an average of over 34% of pumped water is lost as NRW as a result of theft, tampering, meter inaccuracy and faulty distribution networks.

For Europe, France smart water metering market will exceed an annual installation of two million units by 2024. Growing administrative emphasis for replacement of conventional meters coupled with financial government assistance will stimulate the business landscape. Foreign collaborations toward the deployment of high performance advanced systems along with efforts to reduce water theft will further enhance the industry outlook.

US smart water metering market will witness growth of over six percent by 2024. Increasing efforts to map water leakage through distribution mains coupled with replacement of existing pipeline networks will further boost the industry growth. As per IBNET, in the US, an average of 24% water is lost per year as NRW.

AMI smart water metering market is predicted to witness robust growth owing to its ability to monitor unmetered water consumption while eliminating related metering discrepancies. Growing consumer inclination toward resource conservation and accurate billing will further complement the technology adoption.

Rising demand for accurate billing along with operational cost optimisation will augment the smart water metering market. Increasing investment in development of smart grid infrastructure along with enhanced efforts for resource conservation will further complement the business outlook.

Utilities smart water metering market is anticipated to witness an appreciable growth on account of intensifying water conservation measures in response to excessive NRW losses. Improved customer service, reduction in operational expenditure and workforce management are some of the distinguishing features validating the product’s supremacy across utilities. For instance, several utilities including the Alabama Decatur Utilities have accelerated the sturdy rollout of these meters throughout the US.

Growing private sector investments coupled with proactive adoption of smart technology solutions will propel the China smart water metering market growth. Rollout of cellular technology solutions along smart city projects for ensuring environmental sustainability will further boost the product adoption. For instance, in 2016, a smart city investment hub was launched in China as a part of the China's 12th and 13th five-year plan. The initiative augments the demand for effective water monitoring and allocates funds to deploy smart meters across the nation’s water networks.

Increasing efforts for effective resource utilisation coupled with positive measures to meet water scarcity across different regions will boost the hot smart water metering market. Widespread utilisation of these meters across residential establishments will further boost the product adoption.