CMOS image sensors stay on stairway to record revenues

Despite an expected slowdown in growth this year and in 2020, the CMOS image sensor market is forecast to continue reaching record-high sales and unit volumes through 2023 with the spread of digital-imaging applications offsetting weakness in the global economy and the fallout from the US-China trade war.

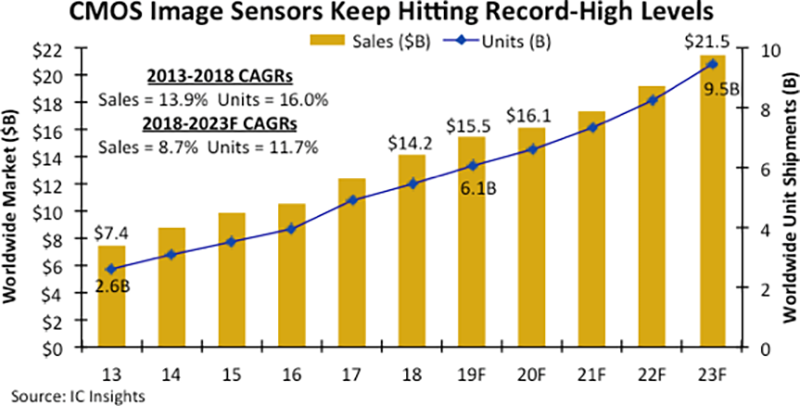

CMOS image sensor sales are projected to rise nine percent in 2019 to an all-time high of $15.5bn, followed by a four percent increase in 2020 to $16.1bn, according to IC Insights’ 2019 ‘O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes’.

IC Insights is forecasting an 11% rise in CMOS image sensor shipments in 2019 to a record-high 6.1 billion units worldwide, followed by a nine percent increase in 2020 to 6.6 billion when the global economy is expected to teeter into recessionary territory, partly because of the tariff-driven trade war between the US and China.

In 2018, CMOS image sensor revenue grew 14% to $14.2bn after climbing 19% in 2017. CMOS image sensor sales have hit new-high levels each year since 2011 and the string of consecutive records is expected to continue through 2023, when sales reach $21.5bn, according to the 350-page O-S-D Report.

Worldwide shipments of CMOS image sensors also have reached eight consecutive years of all-time high levels since 2011 and those annual records are expected to continue to 2023, when the unit volume hits 9.5 billion, based on the O-S-D Report forecast.

China accounted for about 39% of all image sensors purchased in 2018 (not counting units bought by companies in other countries for system production in Chinese assembly plants). About 19% of image sensors in 2018 were purchased by companies in the Americas (90% of them in the US), according to IC Insights’ report.

Camera cellphones continue to be the largest end-use market for CMOS image sensors, generating 61% of sales and representing 64% of unit shipments in 2018, but other applications will provide greater lift in setting annual market records in the next five years.

The O-S-D Report shows automotive systems being the fastest growing CMOS image sensor application, with dollar sales volume rising by a compound annual growth rate (CAGR) of 29.7% to $3.2bn in 2023, or 15% of the market’s total sales that year (versus six percent in 2018).

After that, the highest sales growth rates in the next five years are expected to be: medical/scientific systems (a CAGR of 22.7% to $1.2bn); security cameras (a CAGR of 19.5% to $2.0bn); industrial, including robots and the Internet of Things (a CAGR of 16.1% to $1.8bn); and toys and games, including consumer-class virtual/augmented reality (a CAGR of 15.1% to $172m).

CMOS image sensor sales for cellphones are forecast to grow by a CAGR of just 2.6% to $9.8bn in 2023, or about 45% of the market total versus 61% in 2018 ($8.6bn). Revenues for CMOS image sensors in PCs and tablets are expected to rise by a CAGR of 5.6% to $990m in 2023, while sensor sales for stand-alone digital cameras (still-picture photography and video) are projected to grow by a CAGR of only one percent to $1.1bn in the next five years.