Microcontrollers to regain growth after 2019 slump

After reaching record-high sales in the last two years, the microcontroller (MCU) market slid lower in the first half of 2019 because of overall weakness in electronic systems, a slowdown in automobile sales, and no letup in the trade war between the US and China. In the first six months of this year, worldwide sales of microcontrollers declined about 13% compared to the first half of 2018 while MCU unit shipments fell 14%, according to IC Insights’ Mid-Year Update to the 2019 McClean Report on integrated circuits.

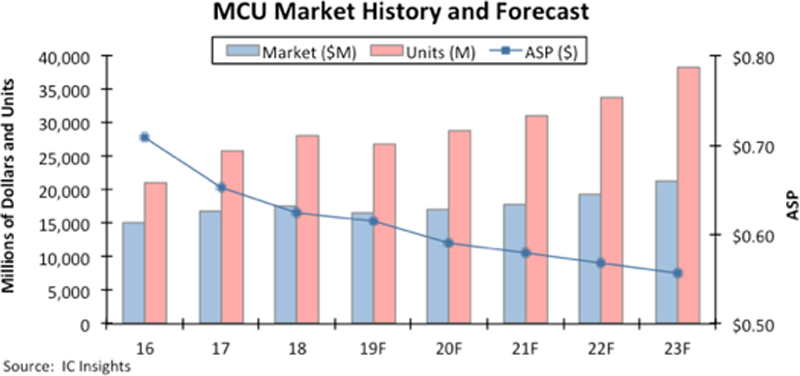

With the MCU market showing signs of stabilising at the midpoint of 2019, microcontroller sales are expected to pull out of the double-digit percentage slump in the next six months and end this year with a 5.8% decline to $16.5bn compared to the all-time high of $17.6bn in 2018 (Figure 1).

Worldwide MCU unit shipments are expected to drop 4% in 2019 to 26.9 billion from 28.1 billion in 2018, says the 200-page Mid-Year Update.

In 2020, the microcontroller market is expected to stage a modest rebound after the 2019 decline, growing 3.2% next year to about $17.1bn, while MCU shipments are projected to increase over 7% and set a new record-high level of 28.9 billion units (surpassing the current annual peak of 28.1 billion reached in 2018).

IC Insights’ Mid-Year Update forecast shows microcontroller sales rising by a Compound Annual Growth Rate (CAGR) of 3.9% in the 2018-2023 forecast, reaching $21.3bn in 2023. MCU unit shipments are projected to grow by a CAGR of 6.3% in the five year forecast period to 38.2 billion in 2023.

MCU unit shipments have been climbing by strong growth rates in most years recently - driven by the spread of automation and embedded control in systems, more sensors, and the rush to connect applications to the IoT - but increases in revenues have been muted by sharply lower ASPs, primarily because of intense competition in the 32-bit microcontroller category.

IC Insights believes significant ASP erosion in 32-bit MCUs has ended with the average selling price forecast to drop by a CAGR of -3.7% between 2018 and 2023 compared to a -16.1% CAGR nosedive in the 2013-2018 timeperiod.

Automotive microcontrollers sales are forecast to drop 5% in 2019 to $6.4bn after rising just 1.1% in 2018 when vehicle sales began slumping. In 2017, worldwide automotive MCU revenues grew 12% on the strength of car sales in the year as well as the spread of sensors in vehicles and increase in Advanced Driver-Assistance Systems (ADAS).

Automotive MCU sales are now projected to rise 1% in 2020 to nearly $6.5bn, followed by gradual strengthening in growth during the 2021-2023 period to reach $8.1bn in the final forecast year. Automotive applications continue to be the largest end-use market for MCUs, accounting for about 39% of total microcontroller sales in 2019. It is worth noting that IC Insights estimates that about 9% of automotive microcontroller sales are currently generated by MCUs involved in IoT connections in vehicles.

Report details: The 2019 McClean Report

Additional details on semiconductor and IC market trends are provided in the Mid-Year Update to The McClean Report - A Complete Analysis and Forecast of the Integrated Circuit Industry. A subscription to The McClean Report includes free monthly updates from March through November (including a 200-page Mid-Year Update), and free access to subscriber-only webinars throughout the year.

An individual-user license to the 2019 edition of The McClean Report is priced at $4,990 and includes an Internet access password. A multi-user worldwide corporate license is available for $7,990.