Top ten semiconductor R&D spenders increase expenditures to $35.9bn

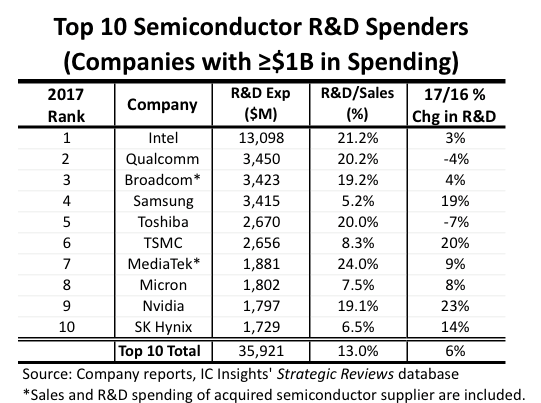

Research has shown that the ten largest semiconductor R&D spenders increased their collective expenditures to $35.9bn in 2017, an increase of six percent compared to $34.0bn in 2016. Intel continued to far exceed all other semiconductor companies with R&D spending that reached $13.1bn.

In addition to representing 21.2% of its semiconductor sales last year, Intel’s R&D spending accounted for 36% of the top ten R&D spending and about 22% of total worldwide semiconductor R&D expenditures of $58.9bn in 2017, according to the 2018 edition of The McClean Report that was released in January 2018. Figure 1 shows IC Insights’ ranking of the top semiconductor R&D spenders, including both semiconductor manufacturers and fabless suppliers.

Intel’s R&D expenditures increased just three percent in 2017, below its eight percent average annual growth rate since 2001, according to the new report. Still, Intel’s R&D spending exceeded the combined R&D spending of the next four companies - Qualcomm, Broadcom, Samsung, and Toshiba - listed in the ranking.

Underscoring the growing cost of developing new IC technologies, Intel’s R&D-to-sales ratio has climbed significantly over the past 20 years. In 2017, Intel’s R&D spending as a percent of sales was 21.2%, down from an all-time high of 24.0% in 2015. In 2010, the ratio was 16.4%, 14.5% in 2005, 16.0% in 2000, and just 9.3% in 1995.

Qualcomm was again ranked as second-largest R&D spender, a position it first achieved in 2012. Qualcomm’s semiconductor-related R&D spending was down four percent in 2017, after a seven percent drop in 2016, and it was close to being passed up by third place Broadcom and fourth placed Samsung, whose R&D spending increased four percent and 19%, respectively.

Figure 1

Despite increasing its R&D expenditures by 19% in 2017, Samsung had the lowest investment-intensity level among the top-10 R&D spenders with research and development funding at 5.2% of sales last year. Samsung’s 49% increase in semiconductor revenue in 2017 (driven by strong growth in DRAM and NAND flash memory) lowered its R&D as a percent of sales ratio from 6.5% in 2016.

Micron Technology’s revenues surged 77% in 2017, but its research and development expenditures grew eight percent, resulting in an R&D/sales ratio of 7.5% compared to 12.5% in 2016. Similarly, SK Hynix’s sales climbed 79% in 2017, while its research and development spending increased 14% in the year, which resulted in an R&D/sakes ratio of 6.5% versus 10.2% in 2016.

Fifth-ranked Toshiba and sixth-ranked Taiwan Semiconductor Manufacturing Co. (TSMC) each allocated about the same amount for R&D spending in 2017. Toshiba’s R&D spending was down seven percent while TSMC had one of the largest increases in R&D spending among the top ten companies shown in the figure. TSMC’s R&D expenditures grew by 20% as the foundry raced rivals Samsung and GlobalFoundries in launching new process technologies, while its sales rose nine percent to $32.2bn in the year.

Rounding out the top ten list were MediaTek, Micron, Nvidia, which moved from 11th place in 2016 to 9th position to displace NXP in the 2017 ranking, and SK Hynix. Collectively, the top ten R&D spenders increased their outlays by six percent in 2017, two points more than the four percent R&D increase for the entire semiconductor industry. Combined R&D spending by the top ten exceeded total spending by the rest of the semiconductor companies ($35.9bn versus $23.0bn) in 2017.

A total of 18 semiconductor suppliers allocated more than more than $1.0bn for R&D spending 2017. The other eight manufacturers were NXP, TI ST, AMD, Renesas, Sony, Analog Devices, and GlobalFoundries.