European semiconductor industry had a strong Q4

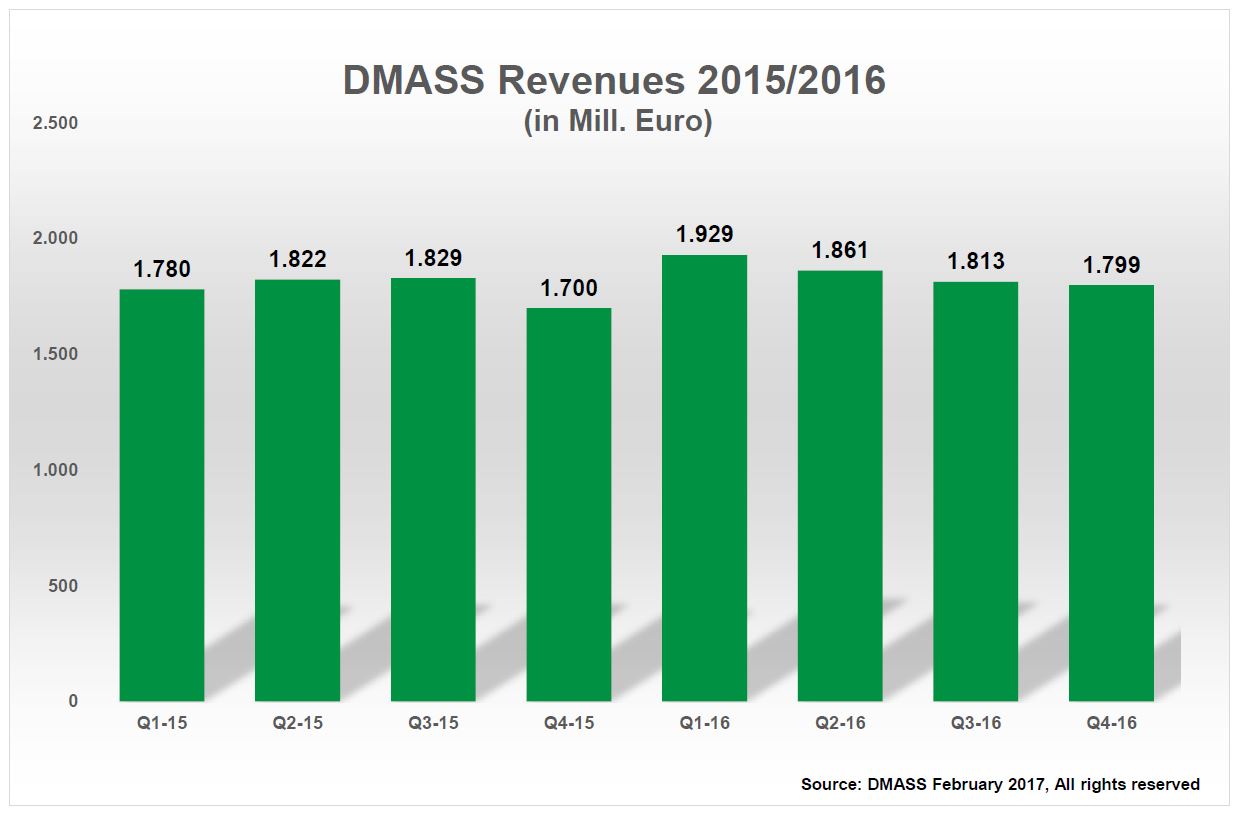

According to DMASS, 2016 started as a dynamic year for the European semiconductor industry, then petered out over summer, but turned back into growth mode with an unusually strong Q4. The quarter ended with €1.79bn in sales, 5.8% higher than Q4/CY15. The full year ended at sales of €7.4bn, which represents an increase of 3.8% over 2015.

Georg Steinberger, Chairman of DMASS, said: “Surely, there were also slight technical effects at work in Q4, like a few more working days. However 80% of the growth of almost six percent seems organic. An encouraging sign for 2017, as we are looking at strong bookings. What is still of concern is the fact that the overall semiconductor market does not really grow and that the pressure on the distribution channel remains unprecedented. Higher growth has definitely been prevented by price and margin pressure.”

Regionally, the major economies trailed the positive trend in Q4. The growth drivers were predominantly countries in Eastern Europe, Israel, Russia, Turkey and Rest of EMEA, while Germany, the UK and France grew slightly below average. Nordic, Benelux and Italy even went backwards. Germany grew by 3.1% to €533m, Italy shrunk by 1.7% to €147m, the UK and Ireland grew by 4.3% to €135m and France by 4% to €128m. The Nordic countries shrunk by 14.6% to €151m, while at the same time Eastern Europe grew by 16.7% to €281m.

Steinberger continued: “There isn’t a lot of news in the regional development, except maybe the increased shift from Northern Europe to the East and the fact that Russia seems to have overcome somehow the effects of the sanctions. With the German economy being in full swing, it is strange that the growth in high-tech products like semiconductors is rather moderate. However, on an annual basis, Germany stayed at the DMASS average, so warning signs may not really be applicable. We are pretty sure that other growth regions and countries as mentioned above experienced currency gains as they mainly invoice in US dollars.”

Product-wise, last quarter the tune of growth was certainly digital, with MOS micro, programmable logic and other digital logic leading the way by double-digit increases of revenue. MOS Micro grew by over 13.2%, mainly driven by microprocessors (non PC) and high-end MCUs, to €395m, programmable logic by 17.2% to €137m and other logic by 15.7% to €100m. Other products standing out as double-digit growth areas were fibre optics, other opto, DRAMs and NAND-flash. The by far biggest product group in distribution – analogue products – grew by a mere 3% to €516m.

Steinberger added: “The danger with products would be to look at quarterly results too seriously, as you can see with above numbers. What grows double-digit in one quarter, could be still trailing the market on an annual basis, like logic in general. And again, it is quite apparent that some areas of strong growth in the recent path, which seem to have lost steam – like power, low-end-MCUs and analogue - are linked tightly to the German market. It remains to be seen if that is a trend or just an occurrence that will disappear in 2017. The only thing clear to us is that 2017 will become a very interesting year, with many changes of structure and policy becoming effective over the next quarters.”