Component shortage caused by continued market boom

The heat shows no sign of abating from the component distribution market as a market boom has caused a shortage.

“We kind of thought that the market might slow down in the past couple of months,” said Graham Maggs, Vice President of Marketing, EMEA at Mouser Electronics. “But nothing of the sort, the market is exceptional. Right now Mouser sales to the end of May are up 42% on the same period in 2017, and we are 19% up on adding new customers.”

Steve Rawlings, Chief Executive Officer at Anglia concurred. “I’ve not seen a market like this,” he commented. The pressure is most felt in the passive components sector – “all the five cents and below components, chip resistors, capacitors, inductors, zener diodes”, as Rawlings puts it.

Lead times show no sign of shortening, and for some components prices have risen 700% since this market boom started. Rawlings had heard of OEM projects being halted or pushed back due to components shortages.

And he noted another trend. “With the shortage of ceramic capacitors and resistors we have seen customers redesigning to use tantalum-based devices although these may be in short supply soon as there are fewer suppliers.”

There is without doubt a scramble to obtain parts in short supply.

Anglia’s Rawlings has a strict rule that sees regular customers at the front of the queue for volume orders.

Maggs said that Mouser sales are being driven by regular customers buying more, new customers and small to medium sized electronic manufacturing services houses. While Mouser does not supply components in big volumes it can “accommodate customers looking to buy 200-300 pieces to keep their head above water for a week,” said Maggs.

“Our CEO Glenn Smith says that you are only a distributor if you hold the inventory the customers want, and there is no doubt we have benefited from his foresight in making major investments in our inventory,” added Maggs. “We can still ship 99.2-99.3% of a Bill of Materials on a same day order. Our order backlog is improving due to our good inventory levels.”

“The benefit,” he continued, “comes from new customers who see what we can do, appreciate our levels of service and then stick with us. That was certainly our experience during the last big boom in 2010/11.”

Anglia’s Rawlings said there is better news on some semiconductor parts. “We’ve seen lead times on microcontrollers come down from 24 to 30 weeks to 12 to 16 weeks, certainly on eight-bit and 16-bit devices.”

Interestingly both Maggs and Rawlings shy away from using the term Internet of Things when asked about applications fuelling the market boom.

“We call it connectivity now, we’ve moved away from using IoT because connectivity is everywhere, in wearables, hospitals, factories and cars” are just a few of the examples Maggs ticked off. “Automotive is growing well on the back of electric vehicles and autonomous cars.”

“We are seeing a bigger European focus on designs in a myriad of applications than I can recall,” he added.

In the UK Rawlings saw plenty of companies looking at IoT or connectivity applications, especially in the SME space.

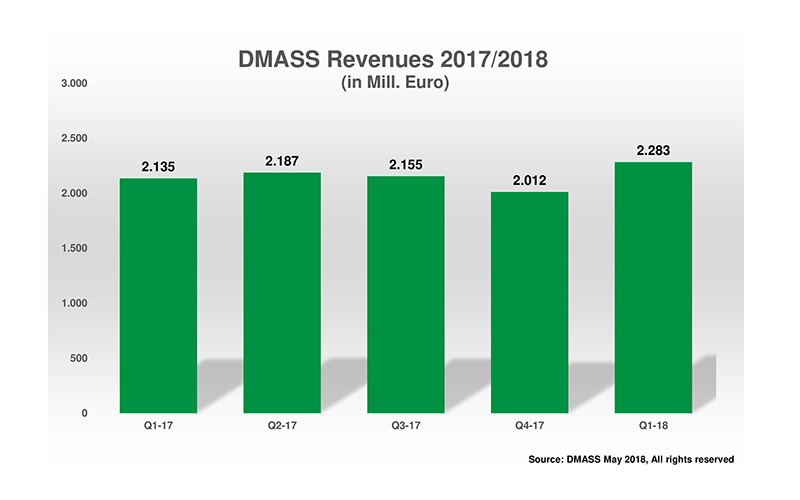

Looking at the broader picture, the European semiconductor industry is continuing its solid growth in 2018. According to latest figures from DMASS, semiconductor sales reported by its members in Q1/2018 ended at a record €2.28bn, 6.9% over Q1/CY17 and 13% above Q4/CY17.

Georg Steinberger, Chairman of DMASS commented: “As we face peak demand in many industries and long lead-times for many semiconductor products, the growth is no surprise. It could have been even higher, considering channel shifts back to some manufacturers and the negative exchange rate effects from a weak US-Dollar. It remains to be seen how sustainable this is, considering that customers have to push out production in many instances due to hard allocation in other component segments. Nevertheless, at the moment outlook is solid.”

Regionally, there was a surprise with double-digit growth being reported in smaller countries in Northern and Eastern Europe as well as in Austria and Iberia.

Among the bigger regions, Italy has grown fastest at 9.7% to €220m, followed by Germany where sales rose 6.4% to €695m. The UK chipped in a 6.3% increase to €166m.

France fell below the average at 3.4% to €157m.

Eastern Europe climbed 12% to €366m and Nordic rose 5.4% to 1€87m.

Steinberger said: “In a nutshell, the smaller countries grew faster than the big ones. The mix of fast-growing countries is surprising, however, reaching from smaller Nordic tech economies to increasingly critical production hubs in Eastern Europe. Italy’s high-tech industry continues to surprise positively as well.”

The products breakdown revealed strong and solid growth in Discretes (Small Signal, RF Discretes), Power Discretes (MOSFETs) and Sensors as well as in Programmable Logic – all double-digit – while Opto, Analogue, Memories and Other Logic (ASSPs) came in short – between 1 and 2.5%.

Analogue, the biggest product group, grew by 2.4% to €672m, and MOS Micro advanced 8% to €477m.

Power rocketed 16.9% to €241m, while Opto (including LEDs) grew at a more sedate by 2.3% to €217m.

Memory sales were up 2.4% to €184m and Programmable Logic reported a 13.5% increase to €153m.

“There isn’t a consistent picture in the product market in Q1,” Steinberger conceded. “Some of the below-average increases in big product categories may be driven by allocation or channel shifts. However, one quarter does not really tell a story. After the dust of various market effects has settled, the situation may become clearer (and so far the weight of the big product groups has not really changed dramatically).”

Phil Gallagher, Global President of Avnet’s Core Distribution Business also reported healthy growth in Europe.

In a call with component distribution markets hosted by Seeking Alpha, he commented: “We're doing extremely well in Europe organically, all divisions in Europe. The automotive and the industrial markets are extremely strong and we continue to play there and we feel we are gaining share. Asia/Pacific has been steady.”

He added that he didn’t see product constraints as an inhibitor of the company hitting its targets.

Similarly, Arrow President and CEO Mike Long told analysts: “Our business model is performing just as we expected to, and our broader supplier engagements brought in new sales and new customers. Our investments in working capital are driving sales, profit growth, and higher returns. We expected last year's healthy momentum for the electronic components to carry into 2018. We've capitalised on the favourable industry backdrop to increase the scale of our business.

If you consider, Asia and Europe components businesses are about 40% bigger than they were two years ago and our Americas business is about 25% bigger. Increasingly, we are the only company for suppliers wanting to reach depth and relevance in fast-growing markets like IoT, industrial automation, smart cities, homes, and vehicles.