5G is transforming FWA performance

Though 5G mobile communications trials are now well underway, due to the scale of investment required, most industry commentators expect full network roll-outs to be several years away. Mouser’s Mark Patrick explains the role of Fixed Wireless Access (FWA).

The global mobile operator community must find a way of balancing future investment requirements against short term cashflow needs. Fixed Wireless Access (FWA), although an established service, is being transformed by 5G technology to the point where it offers performance levels comparable to broadband fibre connections. The performance improvement, along with its relatively low deployment costs and potential for self-provisioning, makes 5G FWA an attractive consumer proposition, and many operators are seizing the opportunity to deploy 5G FWA services to their respective markets. In this article, we examine 5G FWA in more detail.

What is FWA?

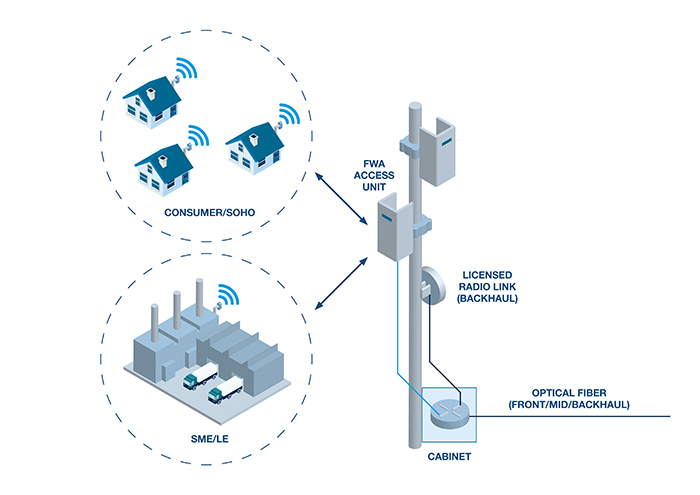

FWA is defined as a broadband connection provided via mobile network-enabled customer premises equipment (CPE). This CPE can have several formats including indoor, (desktop and window) and outdoor (rooftop and wall-mounted). Note that this definition excludes mobile broadband solutions such as those connections provided via portable, battery operated WiFi routers and dongles.

FWA is already well established. EE, for example, launched a service in February 2018 to address the 580,000 UK homes without adequate fixed-line access. With installation costs estimated to be less than 40%, FWA offers affordable and easy-to-install broadband access with the added advantage that the CPE can be self-installed by the subscriber.

Above: Figure 1. FWA Configuration

Despite the convenience of this service, the download speeds and latencies of FWA based on 4G/LTE technology cannot compete with those obtainable from a fibre broadband connection. However, thanks to the significant improvement in network performance, 5G-based FWA promises to be genuinely competitive compared to fibre connectivity, while retaining the convenience and cost advantages.

FWA performance

With its use of the high-frequency spectrum (mmWave), 5G enables multi-GHz FWA speeds and, with latencies as low as 1ms, 5G FWA response times will match those of fixed connections. Indeed, results from initial 5G trials have reported 10 to 25Gbps download speeds, compared with the current average UK home broadband speed of around 30Mbps.

5G promises to transform our lives and unlock substantial economic value across multiple sectors by enabling a wide range of existing and yet to be defined applications. However, the global mobile operator community, charged with rolling out the new network infrastructure, faces several challenges. Although the long-term prospects for 5G are good, significant investments, particularly to support mmWave frequencies, are required to unlock its full potential. At the same time, many operators are still committed to 4G/LTE roll-outs and are also seeing flattening or even decreasing revenues as current services become commoditised. For most, therefore, the 5G business case is not apparent, and priority will be given to investments that will yield early revenue streams.

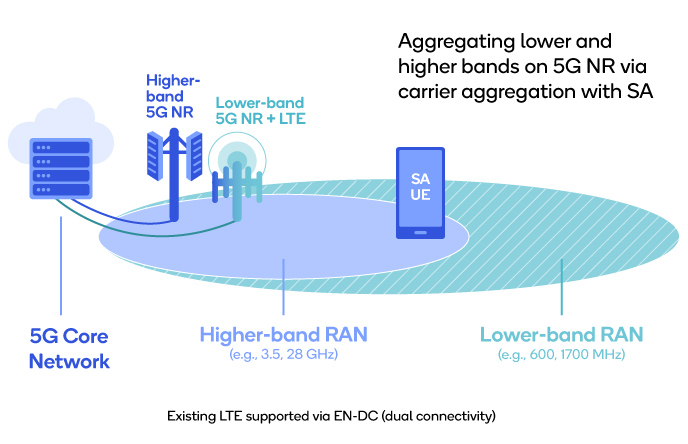

In this context, 5G FWA is a desirable proposition for the operator. A review of global roll-out plans shows that many initial 5G deployments are based on the 3GPP's ‘non-stand-alone’ option, which enables the provision of 5G service in the sub 6GHz spectrum by leveraging existing 4G/LTE network infrastructure. Having committed to these investments, it is relatively straightforward for the operator to provide FWA services from the infrastructure, enabling a high-speed, high-coverage service to rural areas, for example.

In other examples, operators such as Verizon and AT&T have chosen to focus their initial 5G investments on building out mmWave infrastructure to lucrative markets, offering FWA services to consumers in highly populated urban areas.

Whatever the chosen route, analysts agree that FWA services will play a significant role in the 5G launch plans of the global operator community, with Ericsson forecasting a threefold growth in connections between 2019 and 2025. At the same time, SNS Telecom predicts that worldwide FWA revenues, estimated at $1bn at the end of 2019, will grow to over $40bn by 2025, a CAGR of 84%.

Above: Figure 2. 5G NR Non-StandAlone. (Source: Qualcomm)

FWA can be deployed in either the 5G Capacity and Coverage spectrum layer, between 1GHz and 6GHz layer, or in the Super Data layer at the mmWave frequencies of 28GHz and above. At sub 6GHz frequencies, although data throughputs are lower than at mmWave frequencies, coverage is adequate, and FWA can be provided on the back of non-standalone infrastructure. Sub-6GHz deployments can offer download speeds up to 100 times faster than current broadband and are attractive to consumers and businesses who do not have access to fibre. From an operator perspective, deployment of sub 6GHz FWA services enables them to target subscribers in remote areas without building smaller network cells. Additionally, radio waves at this frequency are better able to penetrate buildings, facilitating the use of indoor CPE, which can be despatched for self-installation by the user – a vital factor in the economics of service provision.

At the mmWave frequencies of the Super Data Layer, 5G FWA provides a level of performance comparable to fibre. By using Advanced Antenna Systems (AAS) along with massive MIMO and beam-forming techniques, the resultant narrow beams enable a higher density of users to be served without interference. Although the deployment of 5G FWA at this level requires investment to increase network density, this is offset by the larger number of customers that can be served. On the flip side, mmWave penetration through common building materials is poor, meaning that CPE will require an external antenna to mitigate signal degradation. Although this complicates the installation process, self-installation is still possible in many circumstances. Where it isn’t, operator-managed installations are less complex and costly in cities and urban areas – and, in any case, still much cheaper and faster than fixed line installation.

The need for a strong supplier ecosystem

The global 5G roll-out is driving demand for a wide range of components and equipment, from connectors through to sophisticated RF transceivers capable of operating at mmWave frequencies. With the standards for the core 5G networks now fully defined (in 3GPP release 15), the 5G supplier ecosystem can confidently start developing the components, systems and sub-systems required to support the roll-out.

Qorvo, specialises in the design and manufacture of the specialist RF devices, such as RF ICs, transistors, RF front-end modules, receive and transmit modules, and low-noise amplifiers that power the 5G infrastructure. Qorvo’s products, such as the QPF4001 GaN MMIC, address the challenges of designing at 5G mmWave frequencies.

Conclusion

The 5G roll-out is well underway with operators around the globe executing a range of market entry strategies. The real economic benefit from 5G is still some years away and depends on a full 5G network roll-out, requiring significant investment. While acknowledging this long-term prize, operators must balance future investments against short-term cash flow, and 5G FWA is recognised as a ‘pump primer’ service for 5G, offering fibre-level performance backed by low cost, easy installation.

As the 5G roll-out gathers pace, developers of 5G equipment depend on a comprehensive ecosystem to enable rapid market access and distributors of advanced technologies, such as Mouser Electronics, have a critical role to play in this ecosystem.