Semiconductor capex slow in 2016

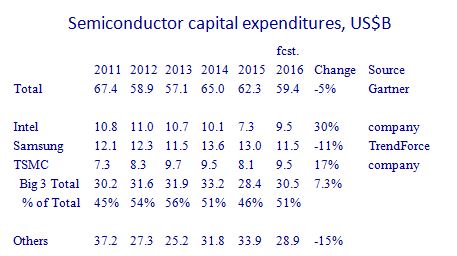

Analysis from consultancy firm Semiconductor Intelligence has shown that the outlook for semiconductor capital expenditures (capex) in 2016 is weak. Gartner’s January 2016 forecast called for a decline of 4.7%. IC Insights in February projected a 0.8% decline. The table below shows the Gartner forecast along with the capex forecasts from the top three spenders (Intel, Samsung and TSMC) which account for about half of total industry capex.

Intel is forecasting $9.5bn in capex in 2016. This is up 30% from 2015, but below Intel’s $10B plus in capex in 2011 through 2014. TrendForce estimates Samsung’s capex will be $11.5bn in 2016, which would be tied with 2013 as the lowest level since 2010.

TSMC plans a 17% increase in capex in 2016 to $9.5bn, in line with TSMC’s record $9.7bn in capex in 2013. Based on Gartner’s forecast and the estimates for the top three, the implied capex for the rest of the industry is a 15% decline. Using IC Insights forecast for a 0.8% decline in 2016 capex would mean the rest of the industry would see a seven percent decline.

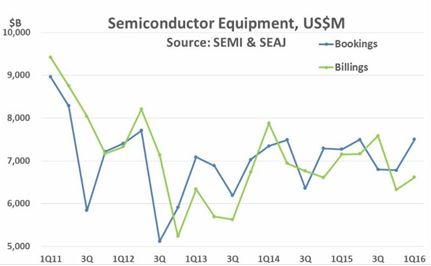

The weak outlook in semiconductor capex is reflected in the projections for semiconductor manufacturing equipment. Semiconductor Equipment and Materials International (SEMI) in December 2015 forecast a 1.4% increase in equipment sales in 2016. Gartner in January 2016 projected a 2.5% decline. The chart below shows the latest combined data on semiconductor manufacturing equipment bookings and billings from SEMI and SEAJ (Semiconductor Equipment Association of Japan) for first quarter 2016.

1Q 2016 billings were US$6.6bn, down seven percent from a year ago. Bookings were US$7.5bn, up three percent from a year ago. The book-to-bill ratio of 1.13 points to growth in billings in the next few months. If this trend continues, year 2016 billings for semiconductor manufacturing equipment could reach the SEMI forecast of 1.4% growth.

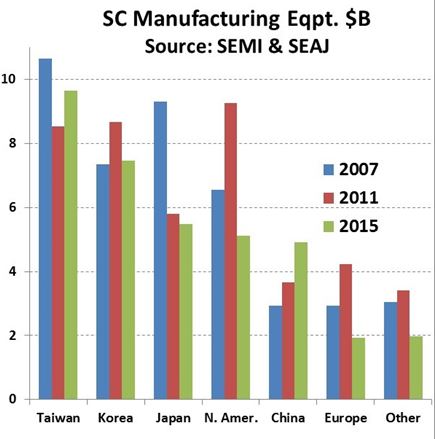

SEMI and SEAJ data shows equipment sales hit a peak of $42.8bn in 2007. Sales declined severely in the industry downturn, hitting a low of $15.9bn in 2009. Sales rebounded to a new peak of $43.5bn in 2011. Over the last four years, sales have ranged between $32bn and $37bn. Sales were $36.5bn in 2015. Sales by region have varied significantly comparing the 2007 and 2011 peaks to 2015. The chart below shows SEMI/SEAJ data of semiconductor manufacturing equipment sales by region.

Taiwan is the largest regional market with sales of around $10bn. The vast majority of sales in Taiwan are to wafer foundries such as TSMC and UMC. South Korea is a close second, with sales of $7bn to $8bn. Sales in South Korea were slightly higher than in Taiwan in 2011. South Korea sales are primarily to memory companies Samsung and SK Hynix. Japan sales declined from $9.3bn in 2007 to $5.5bn in 2015. Toshiba, Sony and Renesas are the major customers in Japan. North America (primarily the US) sales went from $6.6bn in 2007 to $9.3bn in 2011, making North America the largest region in 2011. Sales dropped to $5.1bn in 2015. Intel is the largest buyer of semiconductor equipment in North America, with Micron Technology second. China was the only region to see growth from 2007 to 2015 with sales increasing 68% to $4.9bn. Europe and other regions each saw sales drop about a third from 2007 to 2015.

Despite the shifting of the semiconductor market to China and other emerging Asian countries, the market for semiconductor manufacturing equipment remains dominated by Taiwan, South Korea, Japan and North America - the sites of the largest semiconductor manufacturing companies. These companies prefer to make most of their multi-billion dollar wafer fab investments close to home. China has seen strong growth in the equipment market, but China's growth rate should slow over the next few years. China should pass Japan and North America in the next few years, but is not likely to pass Taiwan or Korea before the end of the decade.