European semiconductor DMASS reports lower summer quarter

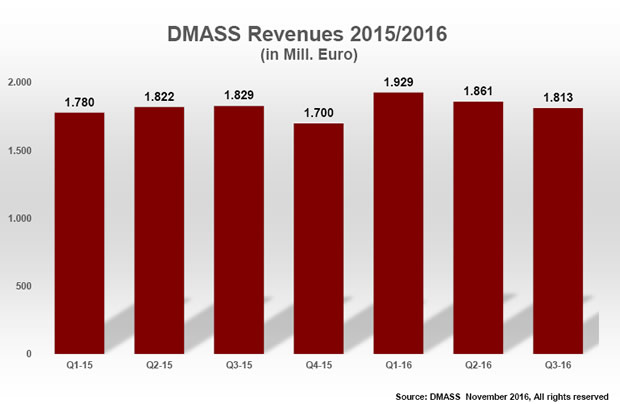

Technical reasons caused a slight decline of sales for the European semiconductor industry in Q3/CY16. According to DMASS, the summer quarter ended with €1.81bn in sales, a decline of 0.9%, mainly due to different quarter-end reporting by some members.

Georg Steinberger, Chairman of DMASS: “Without the technical effect of different quarter-end dates for some DMASS members (last year’s fiscal Q3 had one week more), Q3/CY16 would have been positive, in a similar ballpark as Q2CY16. In other words, 2016 proves quite stable and resilient, compared to record 2015, which was highly influenced by currency effects, and considering the overall economy in Europe, which is not really set to spark a lot of growth fantasies.”

From a regional perspective, the good news happened outside the major economies. While Israel and some other smaller countries grew by double digits and Eastern Europe in general continued to grow, UK, Germany, France and the Nordic countries went down. The UK suffered significant currency effects and a lacklustre market, and declined by 10.5% to €135m although the market was largely flat in local currency. Germany dropped by 4.4% to €570m, France went down slightly by 1.4% to €124m and Nordic declined by 4% to €154m. Surprisingly, Italy grew by 0.1% to €154m; not surprisingly, Eastern Europe went up 5.7% to €260m.

Georg Steinberger: “The aforementioned technical effect may also cause some distortion here, however the trends remain stable: UK is in Brexit trouble, France and Germany experience summer season combined with little inspiration from the overall market, Nordic has its mix of production transfer and summer slowdown. What remains is an unusually strong South (Italy and Iberia) and more low-cost-production driven growth in many Eastern European countries. Overall, the market is slow but not bad and 2016 heads towards a single-digit growth of around 3%.”

In the products groups reported by DMASS, the only major ones with positive news were Analog and MOS Micro. Opto stagnated, Discrete, Power and Memories declined within the expected range. Considerably weak were Programmable Logic and Other Logic. In detail, Analog grew by 1.5% to €548m, MOS Micro by 0.8% to €390m, Opto by 0.2% to €184m. Power lost two percent to €171m, Memory four percent to €144m, Discrete 4.4% to €91m, Other Logic 6.1% to €90m and Programmable Logic 7.8% to €122m.

Georg Steinberger: “Same as last quarter, some special effects influence some distributors in certain product areas, like RF, Programmable Logic and Other Logic (business taken direct by manufacturers). However, on the positive side, there are product areas, which are really promising, like high-end Microcontrollers, some higher end Analog products and sensors, all of which are key components to the quickly developing IoT market.”