The power packaging market is growing

According to a recent report published by Yole Développement (Yole), titled: Power Packaging Technologies Trends & Market Expectations, the power packaging market is growing. Between 2014 and 2020, the interconnection and substrate segments are expected to increase by 14% and 13%, respectively. In addition, the global growth for raw material is expected to reach 12% between 2014 and 2020, with a market of $1.7bn by 2020.

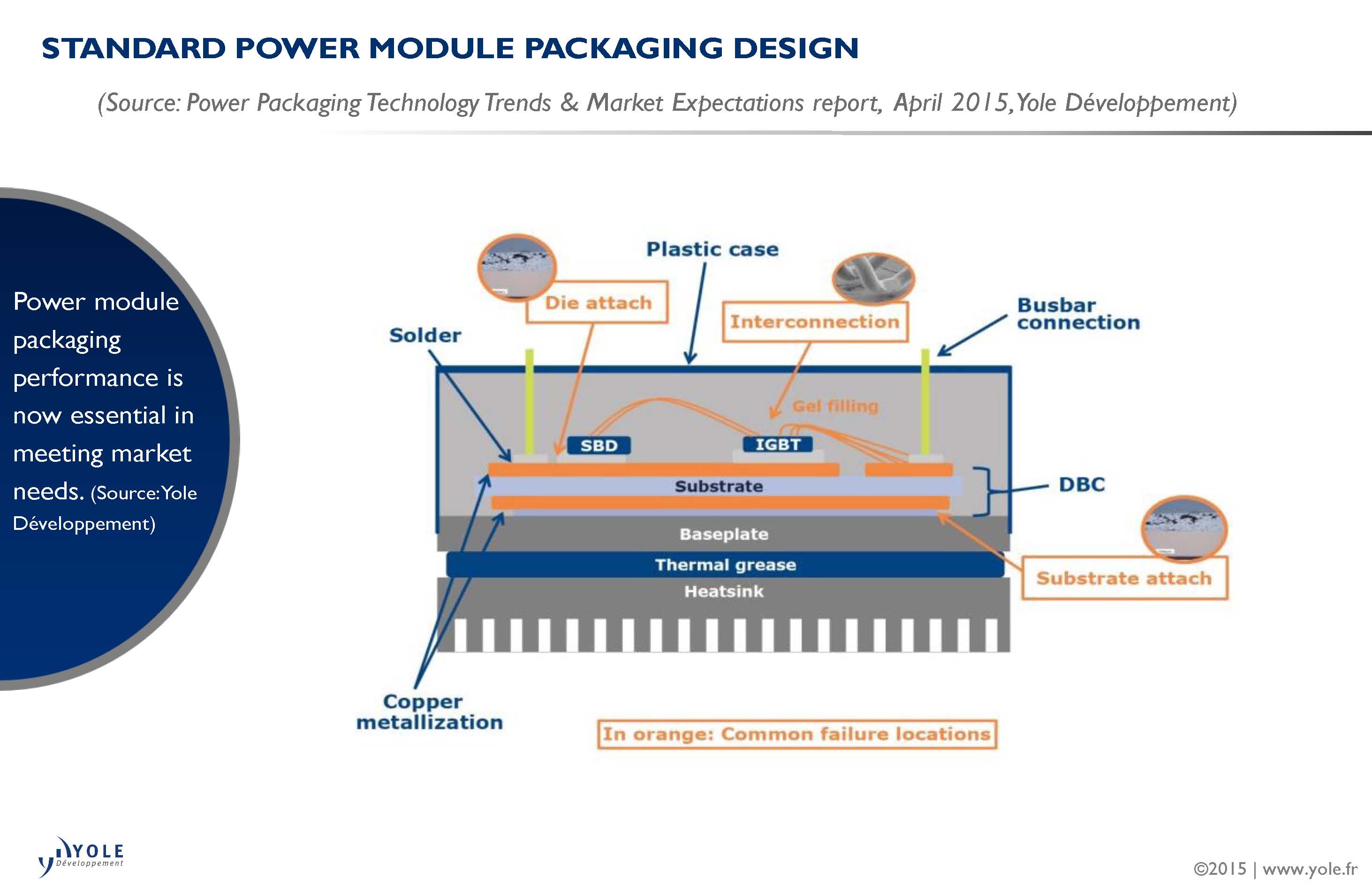

Under this new report, Yole’s analysts propose a deep understanding of the power module packaging design especially at the substrate, thermal interface materials, baseplate, encapsulation, die attach and interconnection levels. With an approach mixing technologies trends and market needs, the Power Electronics team, managed by Dr Pierric Gueguen, reviews the technical issues and analyses the market evolution.

In order to increase power module yield and reliability, companies are working on new products for power packaging, especially for the common failure locations, die and substrate attach, interconnection and encapsulation. Both new designs and new materials can be used, whether to eliminate levels of connection or to improve interfaces. In die attach, for instance, soldering is progressively losing market share, which benefits silver sintering. Although the basic material is more expensive, taking into account cheaper equipment and manufacturing costs and improved reliability, this technology is seducing ever more players. Standard wire bonding is evolving as well, with solutions increasing contact surface, such as ribbon or ball bonding. Encapsulation technologies must evolve to handle high operating temperatures: standard silicone gel or epoxy are limited in terms of temperature, and so new materials such as parylene are being developed.

“Developments for power packaging are needed because power electronics is facing many challenges, due to both environmental and technical requirements”, said Coralie Le Bret, Technology & Market Analyst, Power Electronics and Compound Semiconductors technologies, Yole. “Increasing power density and power conversion optimisation for CO2 emission reduction are key,” adds Le Bret. To achieve ambitious governmental targets and to respect volume constraints, technology breakthroughs are needed at device and module level. Moreover, the growing and important role of Wide Band Gap semiconductors makes efficient packages mandatory, so that devices’ high frequency, high voltage or high temperature capabilities can be best exploited.

“Developments for power packaging are needed because power electronics is facing many challenges, due to both environmental and technical requirements”, said Coralie Le Bret, Technology & Market Analyst, Power Electronics and Compound Semiconductors technologies, Yole. “Increasing power density and power conversion optimisation for CO2 emission reduction are key,” adds Le Bret. To achieve ambitious governmental targets and to respect volume constraints, technology breakthroughs are needed at device and module level. Moreover, the growing and important role of Wide Band Gap semiconductors makes efficient packages mandatory, so that devices’ high frequency, high voltage or high temperature capabilities can be best exploited.

“Growth of EVs and HEVs will drive the power electronics market in the coming year,” commented Dr Pierric Gueguen, Business Unit Manager, Yole. That brings particular requirements, like size and cost constraints, large production volumes and ability to automate assembly. Packaging improvements will go with these specific requirements. Applications also increasingly need to work at high voltage or high temperature. Innovations are also needed so that system packages can support harsh working conditions.

What about the supply chain? “Vertical integration is progressing,” said Yole. In order to increase performance and to reduce losses, more and more power electronics applications choose to use power modules instead of discrete components. In this context mastering power module assembly is mandatory for manufacturers. Power module manufacturing becomes a key step and a hotly contested area between device makers and inverter makers. The main trend for power module makers is sourcing package materials from specialised companies and to assemble the module in-house. Developing new designs is also a good business development opportunity for small companies or start-ups, even if for many fields regional preferences still exist. Different types of business model are presented in Yole’s report, as well as specialised companies for each part of the final package.