The MEMS industry gets its 2nd wind

According to Yole Développement's latest MEMS report 'Status of the MEMS Industry', the MEMS industry is preparing to exceed $20bn by 2020 (in 2014 it represented an $11.1bn business for Si-based devices).

Jean-Christophe Eloy, President & CEO, Yole Développement, comments: “We have seen different market leaders in the past and the competition is still very open. But 2014 will be remembered for the emergence of what could be a future 'MEMS Titan': Robert Bosch (Bosch).”

In this report, Yole proposes a deep understanding of the MEMS markets trends and players dynamics. The company announces its 2014 MEMS manufacturers and foundries ranking and proposes an overview of the future game-changers including new devices, disruptive technologies, 300mm wafers, sensor fusion and new markets.

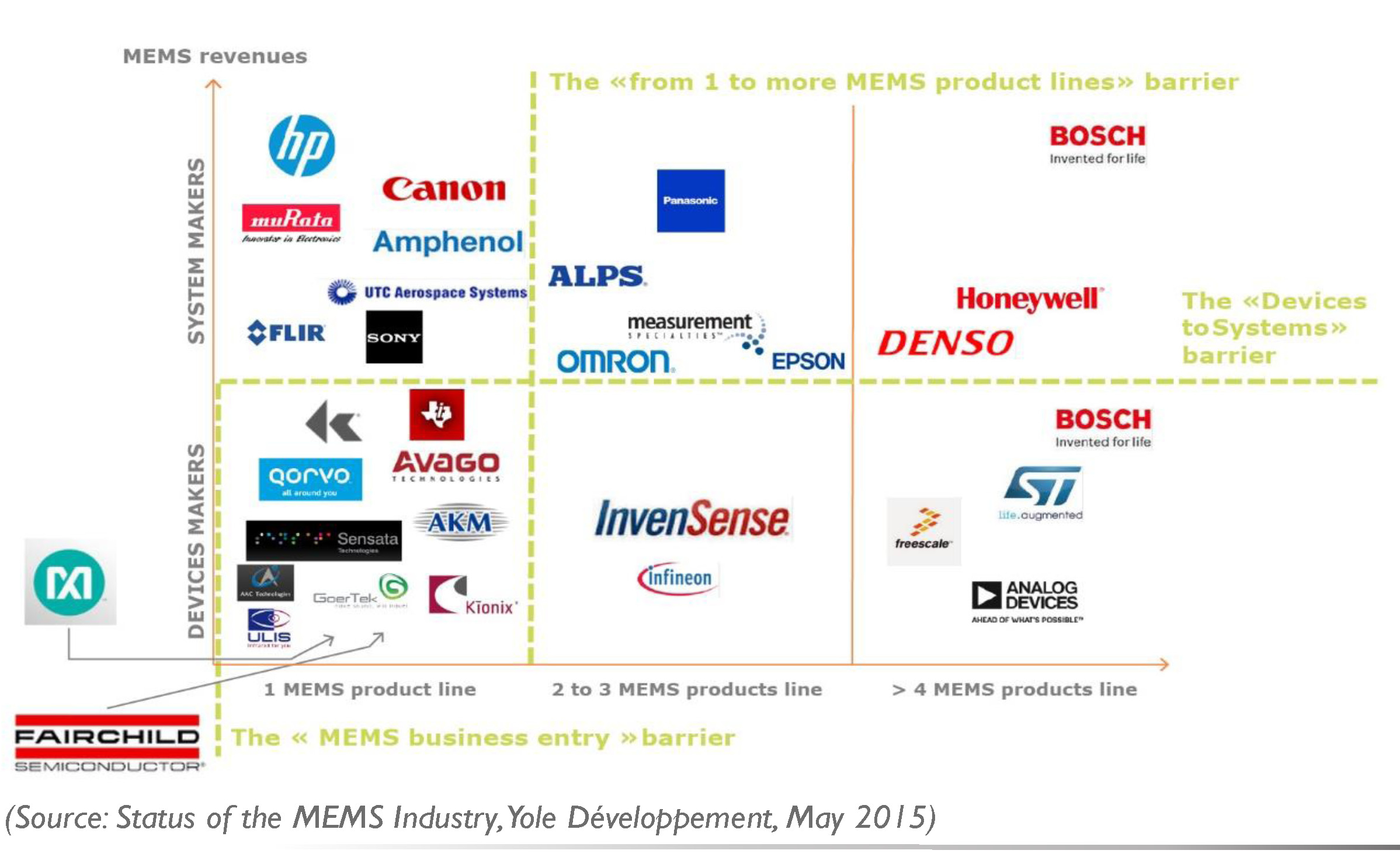

Top 30 MEMS players' positioning: devices vs. systems vs. number of MEMS product lines

Bosch’s MEMS revenues have increased by 20% to top $1.2bn, driven by consumer sales. STMicroelectronics’ revenue is thus now lagging $400m behind. Compared to 2013, the top five companies remain unchanged and together they earn $3.8bn, around a third of the total MEMS business. However, Bosch’s dominance is clear, as its revenues now account for around one-third of that figure. Among the 10 or so MEMS titans that are currently sharing most of the MEMS market, Yole distinguishes the 'Titans with Momentum' from the 'Struggling Titans':

- The 'Titans with Momentum' group includes Bosch, InvenSense and others. “Bosch’s case is particularly noteworthy as it is today the only MEMS company in dual markets – namely automotive and consumer – that has the right R&D/production infrastructure,” states Dr Eric Mounier, Senior Technology & Market Analyst, MEMS devices & Technology at Yole.

- STMicroelectronics, Texas Instruments, Knowles, Denso and Panasonic are part of the second group, 'Struggling Titans'. These companies are currently struggling to have an efficient value growth engine.

- A third family is the upcoming 'Baby Titans' like Qorvo and Infineon that have grown significantly in the past couple of years and could become serious MEMS players.

Yole has analysed the three 'Brick Walls' players have to overcome to develop a significant MEMS business. The first is to launch a first MEMS product on the market. The second is moving from one to multiple MEMS product lines to diversify a company’s portfolio. The last is the move from being a device maker to a system maker with a successful MEMS business. So far, only Bosch has achieved a very successful transition.