Slow growth for distribution market in Q2 2016

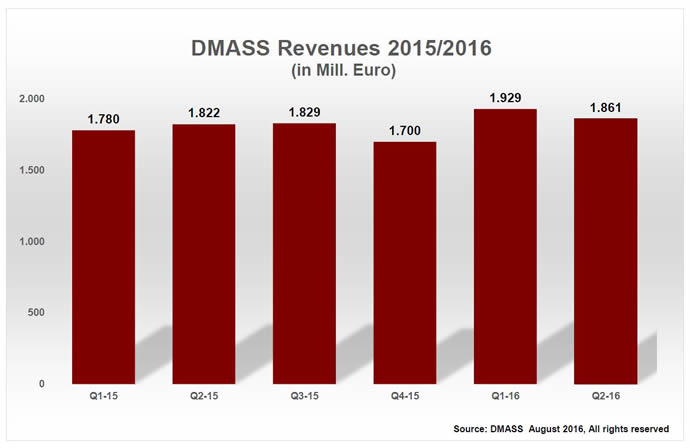

Signs of a seasonal weakness occurred in semiconductor distribution during the Spring quarter. According to DMASS (Distributors’ and Manufacturers’ Association of Semiconductor Specialists), sales in the second quarter grew by 2.15% to €1.86bn in Q2/CY16 over the same quarter last year. Currency effects have eased out in the meantime.

DMASS claims a coverage of 80 to 85% of European Semiconductor DTAM. DMASS only reports industrial semiconductor sales, defined as all semiconductors, excluding the PC channel.

Georg Steinberger, Chairman of DMASS said: “The second quarter ended a bit below our expectations, but bookings are still holding up. The first half of 2016 ended with a healthy 5.2% growth at the EMEA level. We would expect 2016 in total to remain solidly positive, as the slowdown did not occur across the board but was driven by a few special effects, like business having been taken direct by some manufacturers.”

Regionally, the differences in Q2 performance were considerable. While Eastern Europe, Germany, Austria, Iberia and Turkey held up quite nicely, France and Italy finished on average and the UK, Switzerland, Norway, Sweden, Belgium and Luxembourg, Russia, Poland and Israel came back negative. Germany as the biggest market ended the second quarter with €575m (+5%), Italy with €182m (+2.3%), UK with €141m (-1.7%) and France at €137m (+1.6%). Nordic declined to €161m (-10.7%), Israel to €68m (-5%).

Georg Steinberger: “What we are seeing from a regional perspective is a weakening market in the UK, more production transfer from Nordic to Eastern Europe and strong growth in some low cost manufacturing countries in Eastern Europe. There is a lot of movement but, on the positive side, Germany returns a healthy, organic growth and so does Italy. The question is, are we seeing now the end of a long positive streak for distribution or is it just a normal slowdown? I would tend to believe that in spite of a slowdown, the opportunities for organic growth are still excellent in the mature economies.”

On the product side, the picture is as mixed as at the regional view. While Power, Sensors, Opto and MCUs grew way above average, Discretes (here RF) and Logic returned negatively. Analogue and memory grew slightly above average. In detail, analogue products grew by 3.8% to €559m, MOS micro by 3.9% to €387m, optoelectronics by 9.9% to €198m, power by 6.3% to €185m and memories by 3.2% to €146m. On the negative side were discretes (-4.2% to €96m), programmable logic (-14.8% to €123m) and other logic (-9.5% to €91m).

Georg Steinberger: “There are clearly some special effects at work that hit some distributors in certain product areas, like RF, programmable logic and other logic, some of which are due to manufacturers having taken distribution business direct. Without these effects, Q2 would have ended at around four percent. However, that is part of the game.”

DMASS continues to report to members only on passive components, electromechanical components and power supplies, the latest statistics addition to DMASS.