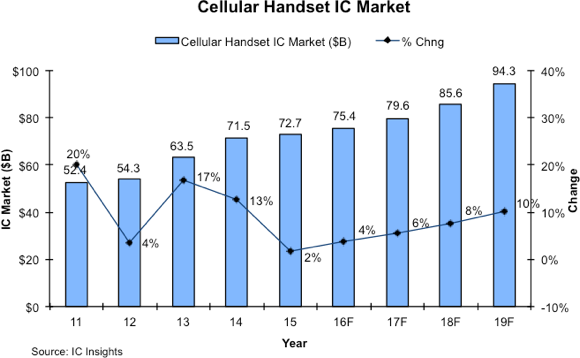

Mobile handset IC market forecast to increase through next three years

The average IC content in mobile handsets and its increasing value, as well as the increasing percentage of smartphones sold as a percentage of total mobile handsets, will help drive the mobile phone IC market to over $94bn in 2019.

Strong double-digit growth rates in the mobile handset IC market were logged in 2013 and 2014 but only a 2% increase was registered in 2015. Despite the expected increase of 4% in 2016, the 2015-2019 total mobile phone IC market CAGR is forecast to be 6.7%, 3.0 points higher than the 3.7% CAGR forecast for the total IC market during this same time. The $94.3bn 2019 mobile phone IC market is forecast to be about 30% higher than the level registered in 2015.

In 2015, the IC product segment that had the highest average content per mobile phone was the MPU category ($9.92), which includes the application processors used in smartphones. The second highest was the application specific logic segment, which had an average $8.55 of IC content per mobile handset.

In total, there was an average of $38.78 worth of ICs in a 2015 mobile handset. DRAM memory held 59% ($12.3bn) of the total mobile phone memory market in 2015, with NAND flash representing most of the remainder of the market. The $21.0bn mobile phone memory market in 2015 was driven by the surge in shipments of memory-rich high-end smartphones and the 6% increase in the mobile phone DRAM market.

The average analogue content in a mobile phone increased in 2015 to $6.64 while the total mobile phone analogue IC market increased by 8%, six points better than the 2% growth rate experienced by the total 2015 analogue IC market. Application specific analogue, mostly comprised of mixed-signal devices, represented about 83% of the total $12.5bn 2015 mobile handset analogue IC market.

In 2019, as the market shifts more toward low-end smartphones, the mobile phone MPU market is expected to represent 23% of the total mobile phone IC market, down two points from 26% in 2015. Moreover, the mobile phone DRAM memory market in 2019 is forecast to reach $19.9bn and be more than two times larger than the total flash mobile phone IC market ($9.5bn) in that year. In contrast to the high-growth mobile phone DRAM market, the 2019 mobile phone DSP market is forecast to be less than $0.1bn, down from $1.3bn in 2012.