MCU market forecast to reach record high revenues

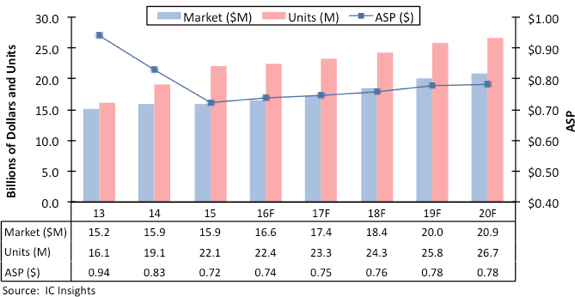

The IC industry’s original SoC product category, MCUs, is expected to steadily reach record-high annual revenues through the second half of this decade despite an overall slowdown in unit growth during the next five years. MCU sales barely increased in 2015, rising less than a half percent, to set a new record high of slightly more than $15.9bn, thanks to a 15% increase in MCU shipments that lifted worldwide unit volumes to an all-time peak of 22.1bn last year (Figure 1).

Strong unit growth - driven by smartcard MCUs and 32-bit designs - enabled the MCU market to overcome a 13% drop in the ASP of MCUs to a record-low $0.72 in 2015. Price erosion, especially in 32-bit MCUs, has weighed down MCU sales growth in three of the last four years, but ASPs are now expected to stabilise and increase slightly in the 2015-2020 forecast period, rising by a CAGR of 1.6% compared to a 7.7% annual rate of decline between 2010 and 2015.

Figure 1 - MCU market history and forecast

While ASP erosion is expected to end, MCU unit shipments are forecast to rise at a much lower rate than in the first half of this decade, primarily because of a slowdown in the growth of smartcard MCUs and tighter reins on IC inventories for the “next big thing” - the IoT. IC Insights’ forecasts MCU sales will rise in 2016 to nearly $16.6bn, which is a 4% increase from $15.9bn in 2015. MCU unit volumes are expected to grow by 2% in 2016 to 22.4bn and the ASP for total MCUs is forecast to rise 2% this year to $0.74. Between 2015 and 2020, MCU sales are projected to grow by a CAGR of 5.5% to nearly $20.9bn in the final year of the forecast. Since the middle 1990s, worldwide MCU sales have grown by a CAGR of 2.9%.

As shown in Figure 1, no downturns are anticipated in MCU sales through 2020. Total MCU revenue growth is expected to gradually strengthen between 2016 and 2019 (when sales are forecast to grow 9%) before easing back to a 4% increase in 2020. MCU unit shipments are now projected to grow by a CAGR of 3.9%.

A major factor in slower MCU unit growth through 2020 is the maturing of the smartcard market, which in recent years has accounted for nearly half of MCU shipments and about 15-16% of total revenue. By 2020, smartcard MCUs are expected to represent 38% of total MCU unit shipments and about 12% of sales.