Major trends set to propel the bioMEMS market

BioMEMS have been used for years, for plenty of applications. Some are linked to solid, mature, slow-growing industries, while others are part of booming applications that are adding new fuel to the bioMEMS market. According to Yole Développement analysts, this market will triple from $2.7bn in 2015 to $7.6bn in 2021.

Indeed, with the barrier between consumer and healthcare blurring, an increasing number of healthcare-related applications are using MEMS components, resulting in impressive market growth. Why is MEMS technology increasingly finding a sweet spot within the healthcare sector? What is the added-value of this technology? What are the drivers of this market? Who is developing what?

Analysts from Yole propose a comprehensive technology and market review of the microsystems for healthcare applications. Titled BioMEMS: Microsytems for Healthcare Applications, this report provides an overview of the diverse bioMEMS components and applications, along with a detailed key players’ description at each level of the supply chain with market shares and related activities. It highlights threats and opportunities related to BioMEMS components along with market and technology trends. Yole’s analysis also details the challenges related to implantable devices and highlights the emergence of consumer healthcare with promising and booming applications.

Faced with an ageing 'baby boomer' population, healthcare is more important than ever. In-vitro diagnostics, pharmaceutical research, patient monitoring, drug delivery and implantable devices: all of these fields is growing and system integrators need new innovative technologies. Adopting bioMEMS including accelerometers, pressure sensors, flow sensors, micropumps and others bring improved sensing and actuating functions for all of these healthcare fields.

Sébastien Clerc, Technology & Market Analyst, Yole, commented: “MEMS components are increasingly used by healthcare system integrators. Indeed BioMEMS are used to bring new functionalities, improve performances and costs and enable miniaturised devices.”

Microfluidic devices will cover the largest part of the BioMEMS market in 2021 representing 86% of the total market. Microfluidic chips are increasingly used in life sciences applications. These components will enjoy a 19.2% every year between 2015 and 2021, driven by applications such as Point-of-Care testing.

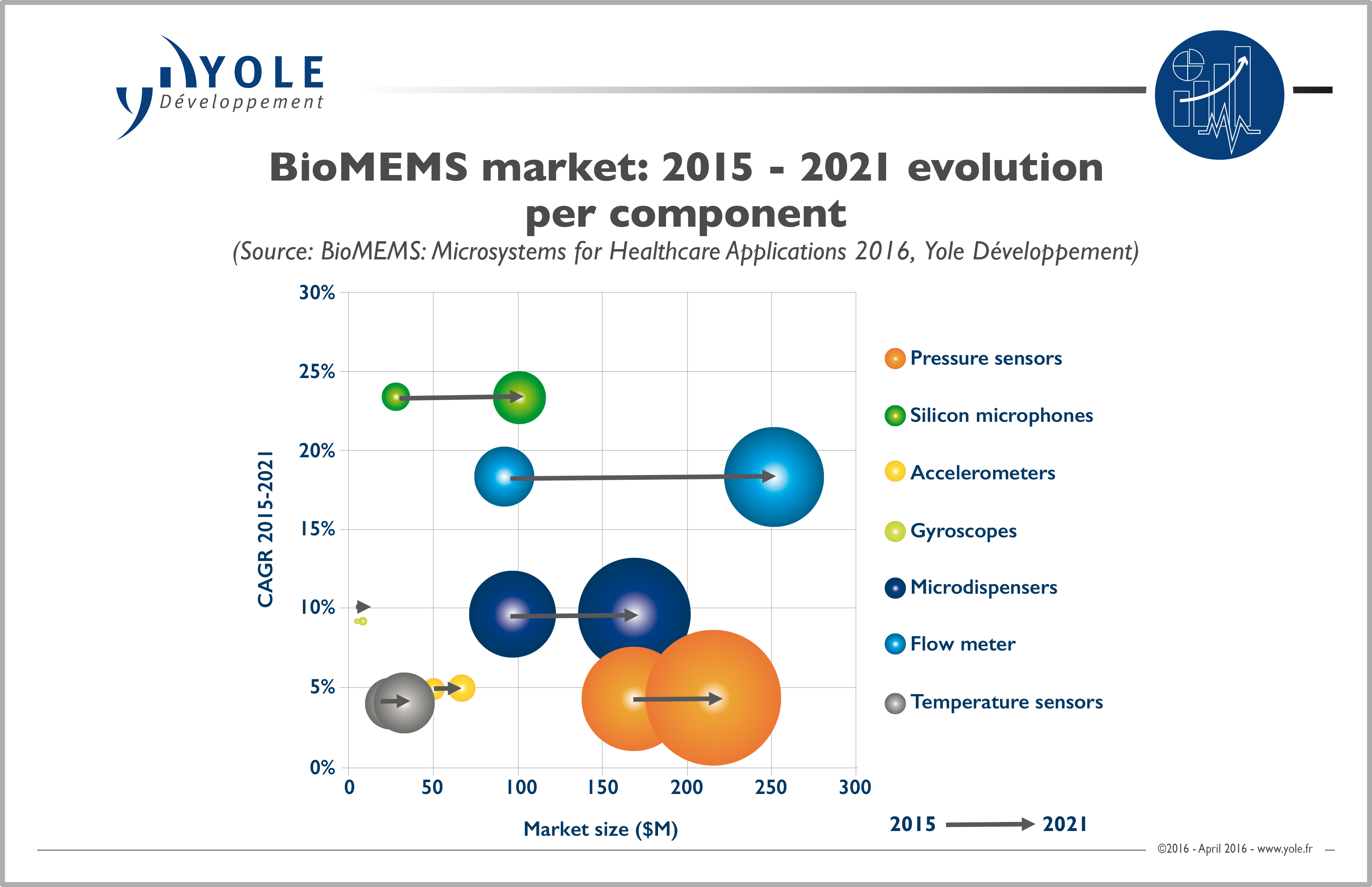

In parallel, silicon microphones and flow meters are showing a double digit growth during the 2015-2021 period (in value): respectively 23.3 and 18.3%. Though silicon microphones are still an emerging and small market, Yole’s analysts confirm the attractiveness of this MEMS technology for hearing aids application, where it brings higher performance than former technologies. They expect a fast penetration into these devices over the next five years. The trend is also positive for flow sensors: indeed Yole highlights an increasing adoption of MEMS disposable devices for drug delivery applications. These disposable BioMEMS components are expected to take an important part of the MEMS flow sensor market in a near future. Until recently, flowmeters were relatively expensive devices and did not suit to drug delivery devices. However today the adoption of disposable sensors for this application opens new high-volumes opportunities for MEMS players. Price reduction was mandatory and MEMS technology successfully addressed the industry needs.

Many other bioMEMS components are also active within the healthcare industry. Yole’s analysts identified pressure sensors, accelerometers, gyroscopes, microdispensers, temperature sensors and more. Their market dynamics highly depend on the related applications and on the ability of MEMS makers to innovate. Lack of strong technical innovations and emerging applications are the characteristics of certain BioMEMS markets. Yole’s analysts give some examples below:

- The pressure sensors market for healthcare applications is showing a slowly growth. 75% of the market is dedicated to the blood monitoring applications. Established for decades, this market is mature with no real disruptive technologies. Reduction of the number of players and attempt to increase volumes are the main trends of this sector for the next years, analyses Yole in its bioMEMS report.

- Accelerometers market is also showing slow growth opportunities. Such devices are today mainly used for CRM applications (implantable pacemakers and defibrillators) which are growing slowly. New applications such as ballistocardiography or fall detection have the potential to boost this market but still represent very low volumes right now.

However the emergence of consumer could change the game and become a real opportunity for MEMS manufacturers with huge volumes. MEMS companies, involved within the consumer market are already considering the consumer healthcare sector. In the meantime, consumer giants acquire promising healthcare and biotech startups and are positioning themselves to address this market. Despite the great promises of consumer healthcare, it will take some time to reach its full potential, highlights the consulting company in its bioMEMS report. Performance, consumer acceptance, reimbursement, reliability, data security. Yole identified numerous barriers preventing rapid explosion of consumer healthcare. Various players have to sit around the table and discuss to find solutions and thus knock down these barriers: Yole expects it will take a few years until consumer healthcare devices are widely adopted.