IoT boosts embedded systems growth

Since 2006, there have been more embedded systems, industrial equipment, sensor devices, instruments, meters, cameras, animals and other objects connected to the internet than humans using computers, smartphones and other electronics. Until recently, steady increases in internet-connected things have been overshadowed by major market battles in smartphones and the emergence of tablet computers, but with growth rates easing in those end-use systems segments, the enormous potential of the IoT has become the hottest topic in electronics and the IC industry.

More than a half-dozen initiatives have been launched to create market standards for IoT and to put it on par with the 'Internet of Humans' in terms of wide-scale availability, ease of connection, and compatibility across platforms in different industry sectors. Assuming that missing IoT standards are developed in the next several years, web-connected things are forecast to account for 85% of nearly 29.5bn internet connections worldwide by 2020, according to IC Insights’ 2015 edition of 'IC Market Drivers - A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits'. In 2010, about 74% of the 7.7bn internet connections were to things, based on market data in the new IC Market Drivers report.

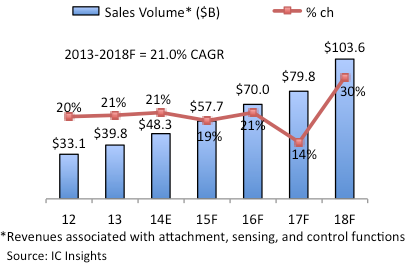

IC Insights estimates that sales generated by the IoT portion of systems (meaning the functions for Internet communications and sensor subsystems) will total $48.3bn in 2014 and grow 19% in 2015 to $57.7bn. By 2018, the market value of IoT subsystems in equipment and internet-connected things is projected to reach $103.6bn worldwide, which represents a compound annual growth rate (CAGR) of 21.0% from $39.8bn in 2013 (Figure 1). More importantly, IoT functionality designed into equipment and web-enabled objects will become a pivotal factor in the sale of nearly half of all end-use systems by the end of this decade as connections to the IoT becomes more common and expected by consumers and businesses.

Figure 1 - Market value of IoT function in 'Things'

The new IC Market Drivers report shows IoT-related semiconductor sales growing 19% to $5.6bn in 2015 and rising by a CAGR of 24.3% in the 2013-2018 period, reaching $11.5bn in the final year of the forecast. About 65% of the projected 2018 IoT semiconductor revenues are expected to come from ICs and 35% from Optical, Sensors/actuators and Discretes (O-S-D). In 2013, about 71% of the $3.9bn in IoT-related semiconductor sales were generated by ICs ($2.7bn) vs. a little over 29% from O-S-D ($1.1bn, most of which was for sensors).

According to the 2015 report, and seen in Figure 2, the largest IoT semiconductor market segment through the forecast period will continue to be connected cities (which includes 'smart' electric grids, roads and streetlights, and other public infrastructure applications) with sales reaching $4.2bn - a CAGR of 15.0% between 2013 and 2018. The second-largest semiconductor IoT category - the industrial internet - will nearly catch up with the connected cities group, primarily due to high growth in factories, logistics, and medical systems applications. Semiconductor revenues for the connected homes category will push past the $1bn mark in 2018 with a CAGR of 32.8% from just $275m in 2013. Connected automotive systems - mainly in passenger cars - represent a high growth potential between 2013 and 2018 with annual semiconductor sales forecast to reach $1.5bn worldwide, which represents a CAGR of 43.8% through 2018. Semiconductor sales for wearable systems that connect to the internet are projected to climb by a CAGR of 46.9% to $528m in 2018 from about $76m in 2013.

![]()

Figure 2 - IoT semiconductor sales by system segments

While the IoT is expected to see strong growth in the next fives years, ICs used in connections to it represented only 1% of total sales in 2014. In 2018, IoT-related ICs are expected to account for about 3% of the total $348.1bn IC market that year, according to the new report’s forecast. Beyond embedded IoT subsystems in connected applications, the proliferation of the IoT will expand the use of cloud computing and web servers as well as require upgrades to the overall Internet infrastructure in order to handle growing amounts of data coming from attached systems and things by 2020. The impact of IoT on servers and the internet is also covered in the IC Market Drivers 2015 report.