Falling prices cut sales growth despite shipment increase

Sensor shipments are getting a big boost from the spread of embedded measurement functions for automated intelligent controls in systems and new high-volume applications, such as wearables and the IoT, but sales growth is being pulled down significantly by price erosion in this market. This is according to IC Insights’ latest report, 'A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators and Discretes'.

Average Selling Prices (ASPs) for all types of semiconductor sensors are forecast to fall by a CAGR of 5% in the next five years, which is double the rate of decline in the previous five years. Unit volume growth is expected to climb by a strong CAGR of 11.4% in the 2014-2019 timeframe and reach 19.1bn sensor shipments worldwide in five years with revenue growth projected to rise by an annual rate of 6.0%. In comparison, sensor sales grew by a CAGR of 17.1% between 2009 and 2014 to reach a record high of $5.7bn last year, according to analysis found in the 360-page report.

ASP erosion is partly a result of intense competition among a growing number of sensor suppliers pursuing new portable, consumer and IoT applications. Sensor ASPs are also being driven much lower because many new high-volume applications require rock-bottom prices. The fall in prices is not only undermining revenue growth in the highly competitive sensor segment, but it is also now squeezing profit margins among suppliers.

Sensors/actuators market overview

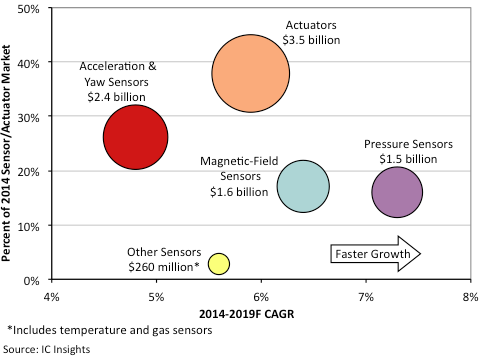

Semiconductor sensors make up nearly two-thirds of the total sensor/actuator market segment. As shown in the image above, acceleration/yaw sensors (i.e. accelerometers and gyroscope devices) remained the largest sensor category, in terms of dollar sales volume, accounting for 26% of the total sensor/actuator market. The acceleration/yaw sensor category continued to struggle due to price erosion and a significant deceleration in unit growth to just 1% in 2014, which resulted in a 4% drop in worldwide sales to $2.4bn after falling 2% in 2013. Magnetic-field sensors (including electronic compass chips) rebounded in 2014 with an 11% increase in sales to set a record high of about $1.6bn after slumping 1% in 2013. Pressure sensor sales remained strong in 2014, growing 15% to a record-high $1.5bn after climbing 16% in 2013.

The forecast in the report shows total sensor sales growing 7% in 2015 to $6.1bn after rising just 5% in 2014. Sensor shipments are projected to climb 16% in 2015 to 12.9bn units after a 13% increase in 2014.

About 80% of the sensors/actuators market’s sales in 2014 came from semiconductors built with MEMS technology, primarily pressure and acceleration/yaw sensors and actuator devices. MEMS-based product sales grew about 5% to a record-high $7.4bn in 2014 from $7.0bn in 2013. Sensors accounted for 53% of MEMS-based semiconductor sales in 2014 ($3.9bn) while 46% of the total ($3.5bn) came from actuators, such as micro-mirrors for displays and digital projectors, microfluidic devices for inkjet printer nozzles and other application, RF MEMS filters and timekeeping silicon oscillators.

In terms of unit volumes, sensors represented 80% of the 5.1bn MEMS-based semiconductors shipped in 2014 (4.1bn) with the remaining 20% being actuators (about 1.0bn).

After dropping slightly more than 1% in 2012 and being flat in 2013, sales of MEMS-based semiconductors recovered in 2014 with actuators ending a two-year decline, rising 7%, and pressure sensors continuing double-digit growth with a 15% increase in the year. Sales of MEMS-based sensors and actuators are forecast to grow 7% in 2015 to $7.9bn and reach $9.8bn in 2019, representing a CAGR of 12.0% from 2014.