Shipments of 'phablets' expected to reach 252m

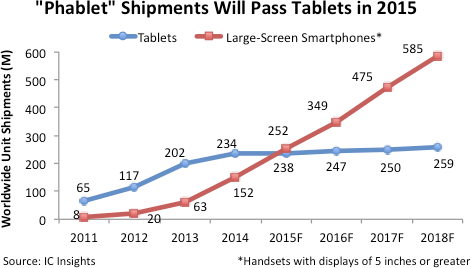

Large-screen smartphones or 'phablets' with displays of 5" or greater are on track to surpass worldwide shipments of tablet computers this year, according to IC Insights’ latest Update to the 2015 IC Market Drivers report. The Update’s forecast shows the popularity of extra-large smartphones continuing to gain momentum in the first half of 2015 with unit shipments now expected to reach 252m this year, which is a 66% increase from 152m sold in 2014 (Figure 1). Strong growth in large smartphones is having a major impact on tablet unit sales, which are forecast to increase just 2% in 2015 to 238m units.

IC Insights believes strong sales of large-screen smartphones will continue in the next three years while the tablet market struggles with low single-digit percentage growth through 2018. The revised forecast shows large-screen smartphone shipments climbing by a CAGR of 40% between 2014 and 2018, while tablet unit shipments are expected to rise by a CAGR of just 3% in this four-year period. Large-screen smartphones are having the biggest impact on mini tablets, which saw a rise in popularity in the past few years.

Mini tablets have 7- to 8.9" displays and typically run the same software as smartphones. The phablet segment is expected to account for 17% of total smartphone shipments in 2015, which are forecast to be about 1.5bn handsets. The Update report shows phablets representing 21% of the 1.7bn smartphones that are forecast to be shipped in 2016. Phablet sales are projected to reach 30% of the nearly 2bn total smartphones shipped in 2018, according to the Update of the 2015 IC Market Drivers report.

Tablet unit sales have nearly stalled out because incremental improvements in new models have not been enough to convince owners of existing systems to buy replacements. More consumers are opting to buy new large-screen phablets instead using both a smartphone and tablet. Large smartphones have gained traction because more handsets are being used for video applications (including streaming of TV programmes and movies) in addition to Internet web browsing, video gaming, GPS navigation and looking at digital photos.

The market for large-screen smartphones received a boost from Apple’s highly successful iPhone 6 Plus handset, which started shipping in September 2014 and continued to gain momentum in the first half of 2015. Apple joined the phablet movement somewhat belatedly, but its 5.5" display iPhone 6 Plus smartphone played a major role in the company shipping 61.2m iPhone handsets in Q115, which was a 40% increase over the same quarter in 2014

Additional details on the IC market for tablets, phablets and smartphones is included in the 2015 edition of IC Insights’ IC Market Drivers—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits. This report examines the largest, existing system opportunities for ICs and evaluates the potential for new applications that are expected to help fuel the market for ICs. IC Market Drivers is divided into two parts. Part 1 provides a detailed forecast of the IC industry by system type, by region, and by IC product type through 2018.

In Part 2, IC Market Drivers examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2018. Some of these applications include the IoT, automotive electronics, smartphones, personal/mobile computing (including tablets), wireless networks, digital imaging and a review of many applications to watch, those that may potentially provide significant opportunity for IC suppliers later this decade. IC Market Drivers 2015 is priced at $3,390 for an individual user license and $6,490 for a multi-user corporate license.