CMOS Image Sensor market expected to reach $16.2bn by 2020

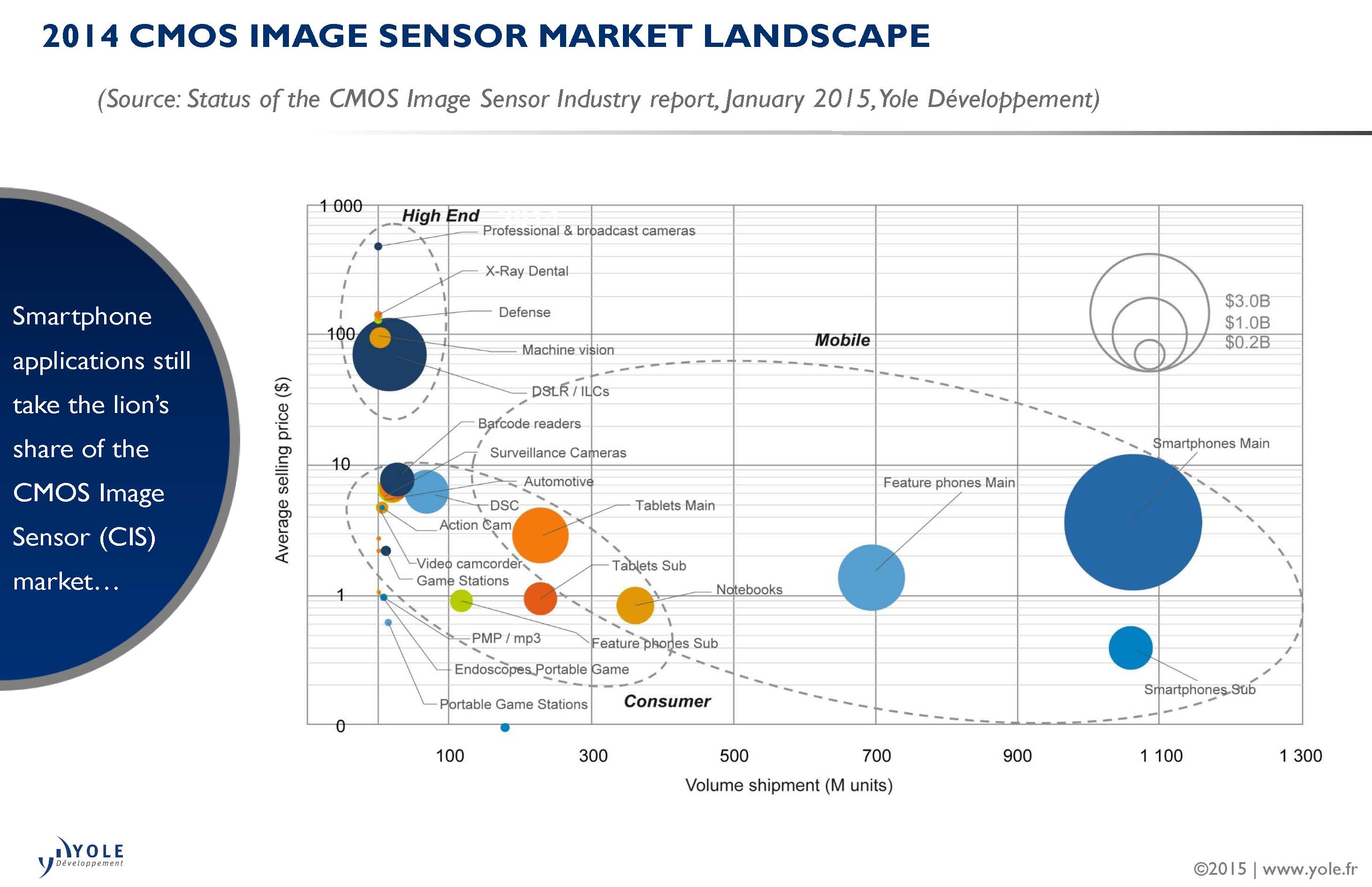

According to a report published by Yole Développement (Yole), the CMOS Image Sensor (CIS) market is expected to grow at a CAGR of 10.6%, reaching $16.2bn by 2020. In the report, titled ‘Status of the CMOS Image Sensor Industry, 2015 Edition’, the company discuss the way in which the automotive, medical and surveillance sectors are driving the market and technology efforts of existing and new players.

The report, which provides an analysis of future technology trends and challenges, presents CIS revenue forecast, volume shipments and wafer production by application, market shares. Exciting new emerging market trends are relevant to the CIS industry. In mobile, the addition of the secondary front-facing camera is already old news, as all high-end handsets and smartphones now have two cameras. In fact, Chinese manufacturers are actually pushing for higher resolution secondary cameras. Naturally, this has had a major impact on the capital expenditures and technology portfolio roadmaps of these CIS mobile players. This trend is even more crucial for main rear cameras, where compactness and performance are pushed to the extreme. Mobile has become a high-performance/high-volume domain in which one player has excelled so far: Sony.

Automotive is the big story this year, as car manufacturers such as Tesla, Nissan and Ford are showing off their first camera-enabled features. Market traction is particularly impressive, with most CIS players enjoying growth rates of 30-50%. However, this is only the beginning, with most CIS players looking at this market, total revenue should reach $800m in 2020. Automotive’s emerging importance promises profound implications for the CIS ecosystem. As CIS moves from a display application towards a sensing application, new players such as processor and software providers will become key partners for sensor design and marketing.

On the other hand, some CIS segments have suffered sharp decline. With feature phone cameras and digital still-cameras being replaced by more widely-used smartphone cameras, players in these applications are suffering, which is leading to industry consolidation. Yole expect the merger and acquisition activity in 2014 to continue into 2015.