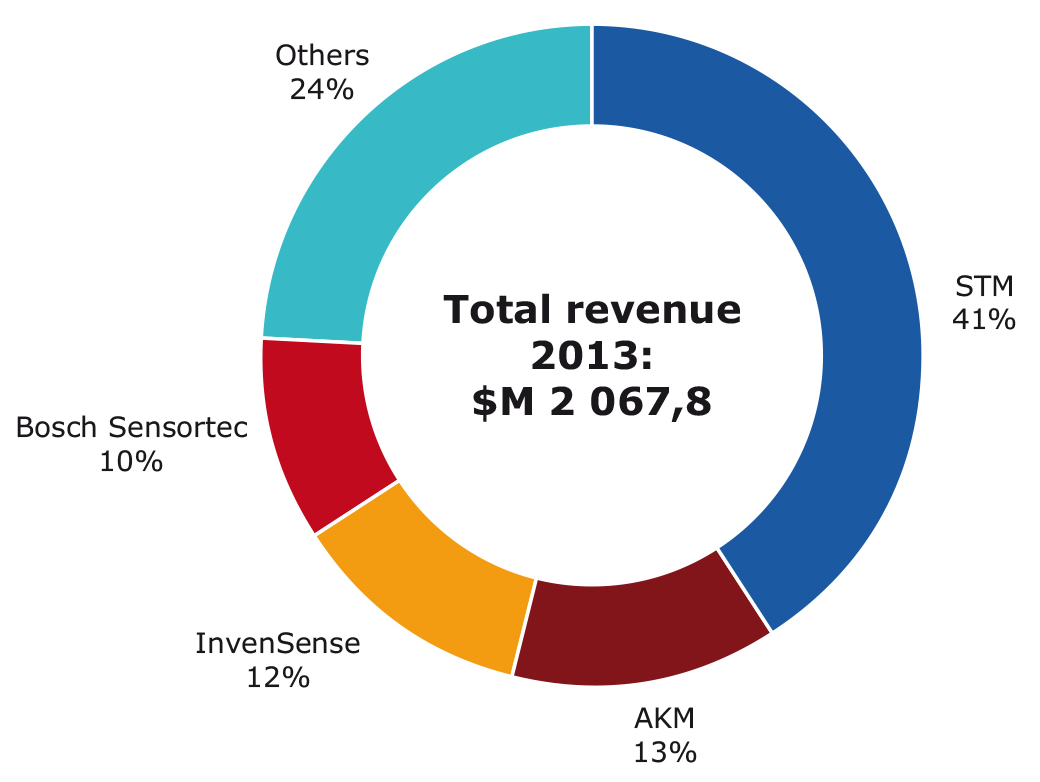

'Big 4' share 75% of consumer inertial combos market

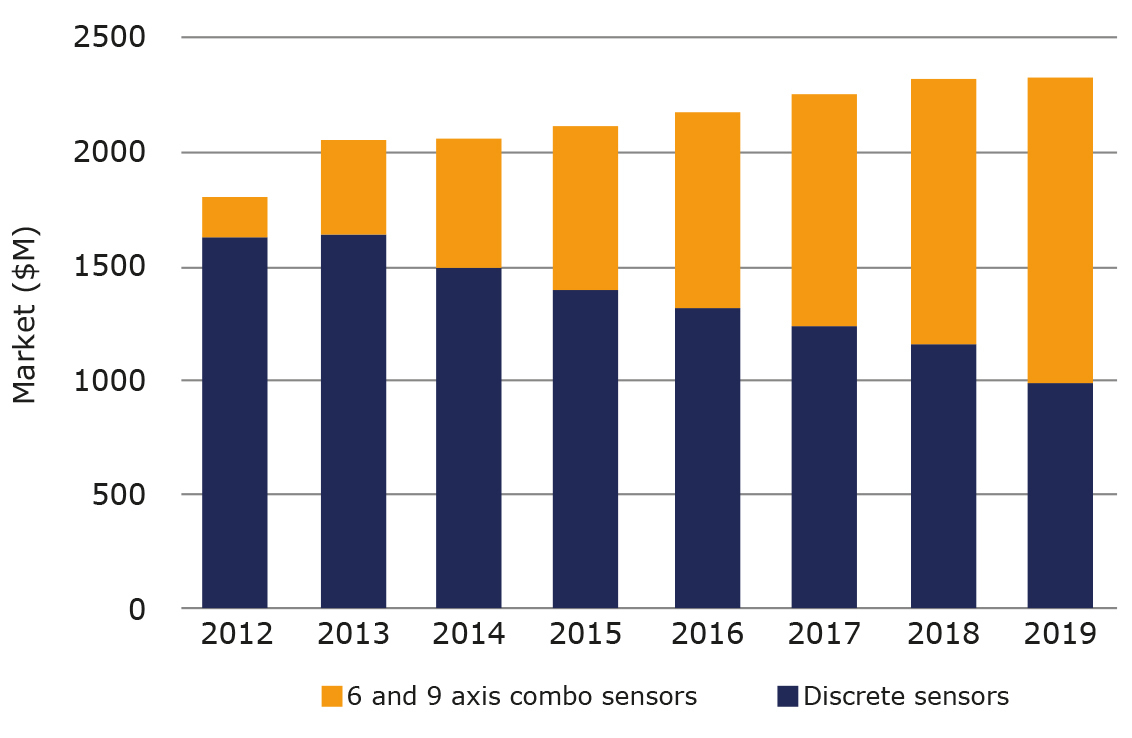

Combo sensors continue their growth in a market expected to reach $1.4bn in 2019, overcoming discrete sensors. Yole Développement proposes a deep analysis of the inertial combos for consumer application, with its report, '6&9 Axis Sensors Consumer Inertial Combos'. According to Yole’s analysis, cellphones and tablets still drive the market but wearables will soon take their place in the landscape.

From the players’ side, Yole’s analysts announce: “The 'big 4' companies in inertial MEMS share 75% of the consumer inertial combos market. Indeed, we see that STMicroelectronics lost high-end smartphone share; in parallel, a strong challenge came from InvenSense and Bosch Sensortec, who both, won Apple’s business..."

ST is still the global leader in the inertial consumer sensor market with 40% market share. InvenSense and Bosch Sensortec hardly compete with it today. InvenSense grew strongly, reaching more than 12%, going ahead of Bosch in the inertial market.

2014 market share for consumer inertial sensors

The ‘big 4’, including AKM, are preparing for the future, with InvenSense holding an advantage as it seems to be ahead in the competition on 9-axis sensors, which are found in a large numbers of products in development, including Google Glass," says Guillaume Girardin, Technology & Market Analyst, MEMS & Sensors, Yole Développement. “Prices are still dropping sharply, with 6-axis IMUs sold to some large volume customers at less than $1 in 2013."

To stay in the race, leaders are going to introduce technical innovations: monolithic integration of 6-axis IMUs into 9-axis IMUs, TSVs, chip scale packaging, and active capping.

Current challengers and newcomers are eyeing this combo opportunity and expect to take market share, even though the supply chain is consolidating. Kionix, Freescale, Alps Electric, Fairchild, Maxim and more than 10 other companies are targeting this market space, but the leaders are well established and competition is hard.

New business models are developing and more fabless companies are likely to be involved in the combo market. Details on newcomer technologies and roadmaps are provided in the report.

The combo sensor market is estimated at $420m in 2013, $585m in 2014, growing to $1.4bn in 2019. This represents 28% of the global inertial consumer market in 2014, and will grow to almost 60% by 2019.

2012-2019 market for consumer discrete & inertial motion sensors ($m)

“While smartphones and tablets are still driving volume increases and adoption of combos, the picture should be different in 2019,” announces Dr Eric Mounier, Senior Analyst, MEMS devices & Technologies, Yole. “Combo sensors will take a significant portion of total market share, but opportunities will remain for discrete sensors, from accelerometers used in basic activity trackers to gyroscopes for camera module stabilisation.”

In Yole’s report, a large range of sensors (e-compass, 6-axis IMUs, 9-axis IMUs) are discussed to understand market growth and transfer from discrete sensors to combos. It provides a deep understanding of the sensor fusion roadmap and its impact on the industry: market opportunities; architectures; technical impact; evolution of the competitive landscape and more.