435m smartphones expected to be shipped in 2015

Smartphones first accounted for more than 50% of total quarterly cellphone shipments in Q113. In Q415, smartphones are forecast to reach 435m units or 80% of total cellphones shipped according to data in IC Insights’ newly released Update to its IC Market Drivers Report. On an annual basis, smartphones first surpassed the 50% penetration level in 2013 (54%) and are forecast to represent 93% of total cellphone shipments in 2018.

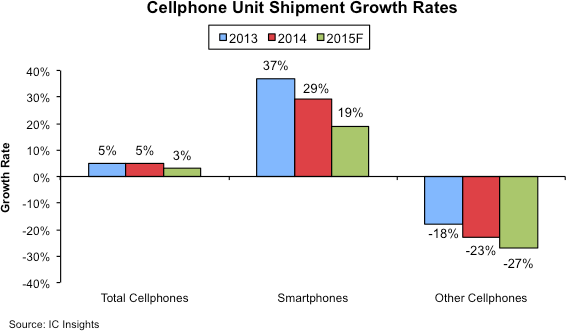

In contrast, non-smartphone cellphone shipments dropped by 18% in 2013 and 23% in 2014. Moreover, IC Insights expects the 2015 non-smartphone cellphone unit shipment decline to be steeper than 2014’s drop with a decline of 27%. Total cellphone unit shipments grew by only 5% in 2014 and are forecast to grow by only 3% in 2015.

Samsung and Apple dominated the smartphone market in both 2013 and 2014. In total, these two companies shipped 457m smartphones and held a combined 47% share of the total smartphone market in 2013. These two companies shipped over 500m smartphones in 2014 (503.9m), but their combined smartphone unit marketshare dropped seven percentage points to 40%. It appears that both Samsung and Apple are losing smartphone marketshare to the up-and-coming Chinese producers like Xiaomi, Yulong/Coolpad and TCL.

In contrast to the weakening fortunes of Nokia, BlackBerry and HTC, 2013-2014 smartphone sales from China-based Lenovo, Huawei, Xiaomi, Yulong/Coolpad and TCL surged. Combined, the six top-ten China-based smartphone suppliers shipped 359m smartphones in 2014, a 79% increase from the 201m smartphones these six companies shipped in 2013. As a result, the top six Chinese smartphone suppliers together held a 29% share of the worldwide smartphone market in 2014, up eight points from the 21% share these companies held in 2013.

In early 2015, there were numerous reports of slowing in the Chinese smartphone market. Since most of the Chinese smartphone producer’s sales are to Chinese customers, this slowdown became evident in their Q115 smartphone sales figures. In total, the top six China-based smartphone suppliers shipped 83.4m smartphones and held a 25% share of the Q115 worldwide smartphone market, down four points from their 29% combined marketshare in 2014.

Chinese smartphone suppliers primarily serve the China and Asia-Pacific marketplaces. Their smartphones, unlike those from Apple, Sony, and HTC are low-cost low-end handsets that typically sell for less than $200. In some cases, smartphones sold by the Chinese companies have been known to sell for as little as $50.

With much of the growth in the smartphone market currently taking place in developing countries such as China and India, low-end smartphones are expected to be a driving force in the smartphone market over the next few years. IC Insights defines low-end smartphones as those that sell for $200 or less and high-end smartphones as those that sell for greater than $200.

Additional details on the IC market for smartphones is included in the 2015 edition of IC Insights’ IC Market Drivers—A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits. This report examines the largest, existing system opportunities for ICs and evaluates the potential for new applications that are expected to help fuel the market for ICs.

IC Market Drivers is divided into two parts. Part 1 provides a detailed forecast of the IC industry by system type, by region, and by IC product type through 2018. In Part 2, IC Market Drivers examines and evaluates key existing and emerging end-use applications that will support and propel the IC industry through 2018. Some of these applications include the IoT, automotive electronics, smartphones, personal/mobile computing (including tablets), wireless networks, digital imaging and a review of many applications to watch. IC Market Drivers 2015 is priced at $3,390 for an individual user license and $6,490 for a multi-user corporate license.